Forty-three states have made changes to their public pension plans in the past few years, with the most recent being Illinois, Ohio and Louisiana. As states battle against budgetary problems, the unsustainability of current pension plans has become a major point of contention. Let's take a closer look at what's going on in those three hotbeds of pension reform.

Many plans guaranteed benefits for their retirees so making changes to them midstream has caused a lot of angst for workers and retirees.

Recommended For You

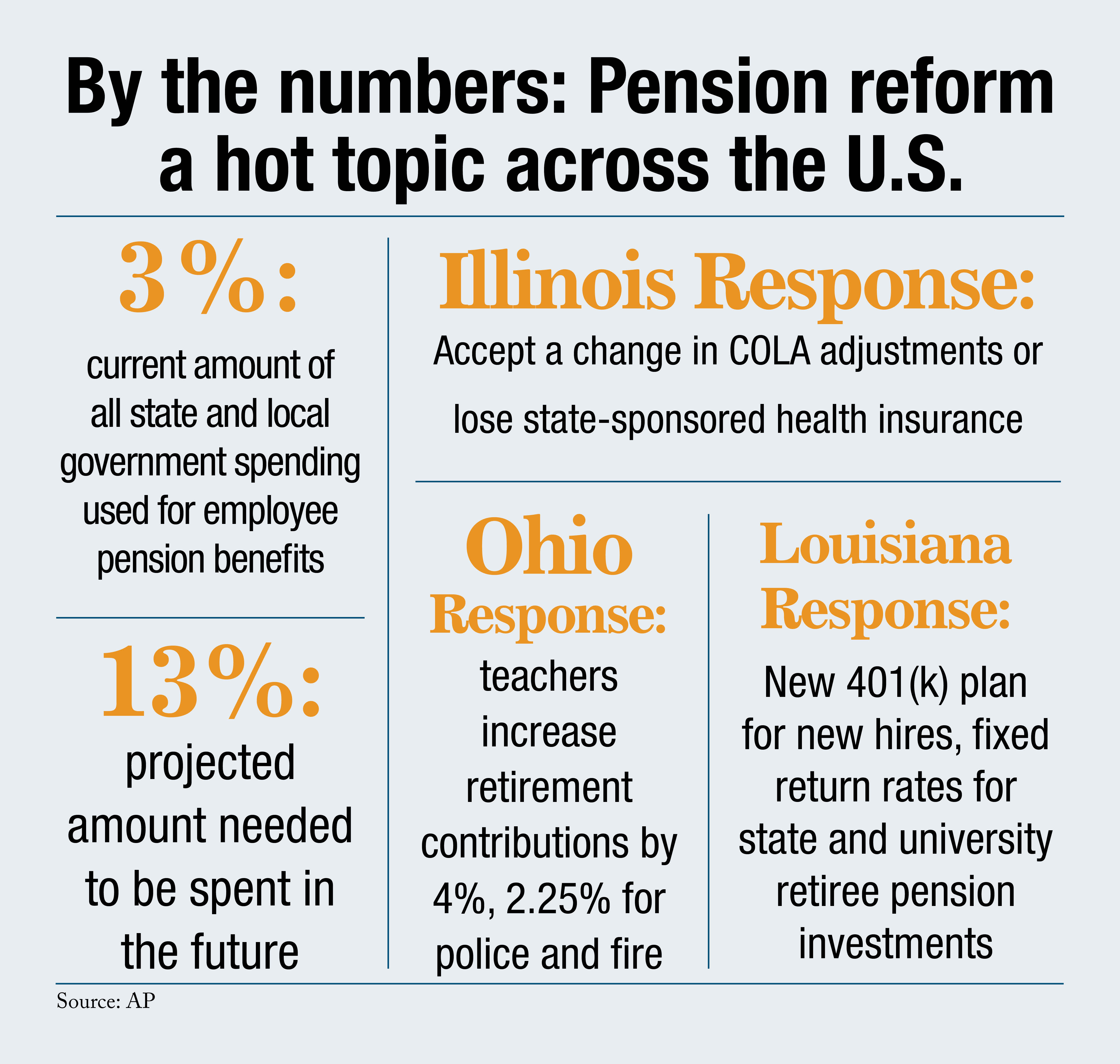

According to the most recent U.S. Census Bureau data, about 3 percent of all state and local government spending is used to fund pension benefits for employees.

The biggest problem, according to the National Association of State Retirement Administrators, is that state and local governments underfunded their pension plans for years and overestimated investment returns on their plans. Both of those conspired to bring pension overhauls to the forefront of legislation. A NASRA issue brief in February 2012 pointed out that required spending on pensions could consume as much as 13 percent of a state's budget.

"The chronic failure by some pension plan sponsors to pay required contributions results in greater future contributions to make up the difference," NASRA found.

"Most states are undergoing significant efforts to tweak/reform/change/rein in the benefits and that's just being responsible stewards of the pension fund," said Ady Dewey, communications and external affairs for NASRA.

Many states are adopting hybrid plans, which mix defined benefit options with defined contribution plan options.

"It is very apparent that despite what you read in the most popular media, the larger pension systems, the ones that are state run…are excessively healthy," she said. The ones that are in trouble are the ones that "didn't build their asset base over time, so less money is being invested and there is less return on that investment," she said.

Illinois House Minority Leader Tom Cross (R-Oswego) testifies at a House pension committee hearing at the State Capitol (AP Photo/Seth Perlman)

Illinois's pension plan overhaul

An Illinois House of Representatives Personnel and Pension committee took the first step toward revamping government pension plans by approving a bill this past week that would cut government pensions and shift retirement costs to schools and universities.

The measure would give employees/retirees two options: They can accept a change in the annual COLA adjustment—from 3 percent compounded to a COLA that is capped at 3 percent or one-half of the consumer price index, whichever is less. The COLA would not be compounded and would not begin until five years of retirement, or age 67, whichever came first, according to the Teachers' Retirement System of the State of Illinois. If TRS members took this option, they would retain access to state-supported health insurance through the Teachers' Retirement Insurance Program.

If teachers and staff reject the changes to the COLA and it remains at 3 percent compounded annually, they give up their right to their state-supported health insurance.

The joint House and Senate legislation also creates a new Tier III benefit structure that would encompass all new TRS members hired after July 1, 2013, which would make members pay an annual contribution of at least 9 percent of salary and state and school districts would pay an annual contribution of 3.4 percent of pay. TRS would pay between 4 and 10 percent of investment earnings on these contributions.

Opposition to the bill stems from the provision that would make local school districts foot the bill for their retirement plans, when they already are experiencing budgetary shortfalls.

The TRS Board of Trustees acknowledged at the end of March that the state's pension system would not be around in as little as 18 years if changes weren't made to the plan.

Workers at the Terminal Tower in downtown Cleveland, Ohio (AP Photo/Mark Duncan)

Ohio Senate passes pension bills

Ohio's Senate passed measures that would change the way four out of the state's five pension funds will operate, according to an article in The Plain Dealer in Cleveland. The funds cover nearly 700,000 contributing members and about 400,000 beneficiaries, with assets of $160 billion.

Members of the State Teachers Retirement System would have to increase contributions from 10 percent to 14 percent of their salaries and Ohio Police and Fire Pension Fund members would have to increase contributions from 10 to 12.25 percent of pay. Two other state plans, the Public Employees Retirement System and the School Employees Retirement System, were not asked to increase their contributions.

The bill is now headed to the House of Representatives.

(AP Photo/Gerald Herbert)

Louisiana passes landmark pension legislation

Louisiana passed a bill May 30 that will create a 401(k)-style pension plan for future state employees. What makes the plan different from other state plans is that it is the first one to provide only a cash balance retirement plan for certain employees, those hired after July 1, 2013.

The pension overhaul was proposed because Louisiana's pension programs are billions short of what they need to pay all benefits promised, according to supporters of the measure. Louisiana Gov. Bobby Jindal has been pushing for changes for months, with a lot of opposition.

Jindal has professed that the changes will save the state lots of money, while opponents disagree, saying the plan will actually cost the state more.

Under terms of the legislation, contributions to the plan by state employees and university staff will be invested. They will never lose money when the market goes down, but Louisiana won't guarantee a specific investment return or a monthly payment based on the worker's highest years of salary, according to a story by the Associated Press.

Emergency workers and public school employees will not experience a change in their retirement benefits because of the legislation.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.