The economic downturn spurred Americans over the age of 55 to make changes to their lifestyle plans, work/leisure expectations and investing strategies, according to a study released this week by AIG Life and Retirement in collaboration with Age Wave.

According to the AIG Retirement Re-Set Study, 72 percent of those surveyed said the recent economic uncertainty provided a financial wake-up call, and 80 percent of those over age 55 said they are now more cautious in their approach to investing. They are far more likely to seek financial peace of mind as a key goal versus potentially higher, but riskier, returns.

"In a new era of flux and uncertainty, Americans are rebounding from a difficult period and showing their resilience by turning toward greater expense control and more responsible retirement planning," said Ken Dychtwald, CEO of Age Wave. "Lessons learned have not been forgotten. Many people are adapting a new retirement mindset and are choosing to work a bit longer, thereby helping to make retirement more affordable. They are re-setting their sights on a revised, more achievable path to retirement."

"In a new era of flux and uncertainty, Americans are rebounding from a difficult period and showing their resilience by turning toward greater expense control and more responsible retirement planning," said Ken Dychtwald, CEO of Age Wave. "Lessons learned have not been forgotten. Many people are adapting a new retirement mindset and are choosing to work a bit longer, thereby helping to make retirement more affordable. They are re-setting their sights on a revised, more achievable path to retirement."

Recommended For You

The 2012 survey, which was conducted online by Harris Interactive, polled 3,426 individuals over the age of 55 in the United States.

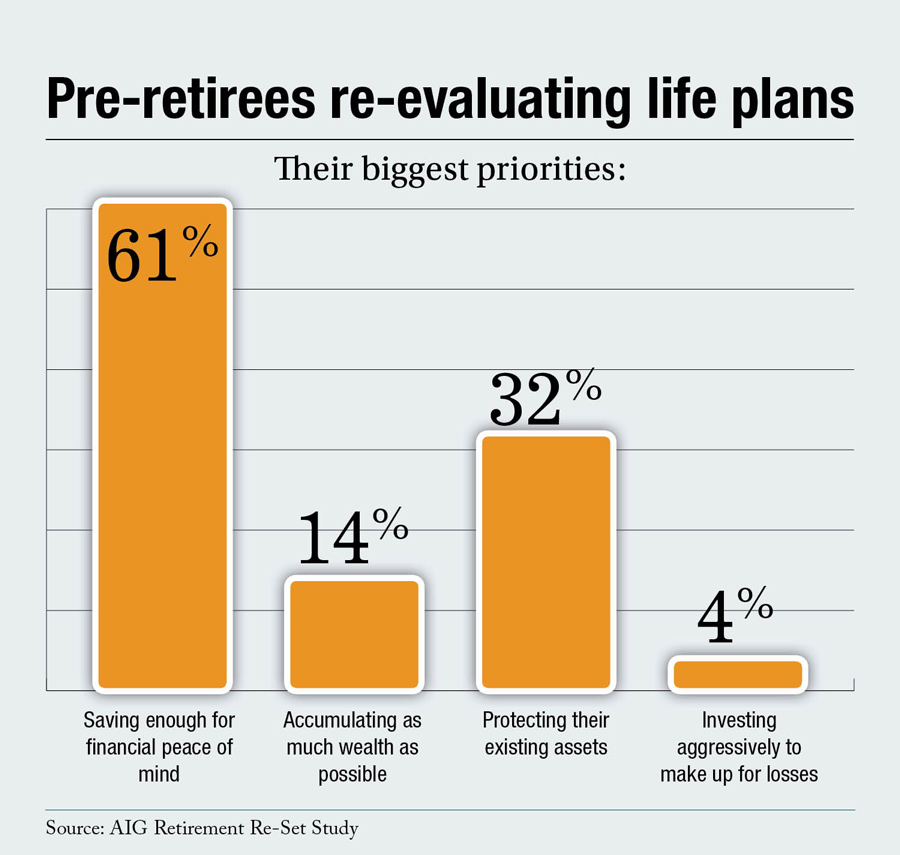

This year's survey found that more than four times as many people chose saving enough to have "financial peace of mind" (61 percent) as a top financial priority compared to accumulating as much wealth as possible (14 percent).

Eight times as many people (32 percent) plan to look into ways to protect existing assets than those who plan to invest more aggressively to make up for lost time (4 percent) in response to the recent economic and financial market uncertainty. And 54 percent expressed concern about their personal financial situation, saying they felt less financially secure than they did a year ago.

"The impact of the most difficult economy in generations has left a lasting impression, with Americans seeing their retirement savings jeopardized by low interest rates and high market volatility," said Jay Wintrob, president and CEO of AIG Life and Retirement. "While the stock market and economy have somewhat rebounded, the confidence that many Americans once had has diminished. People are now looking for stable, lower-risk strategies that will provide the income and security they need in retirement."

"While there has been a great deal of discussion about the economic impact of the past few years, this survey revealed that the psychological impact was also substantial – and a new mindset is emerging," said Dychtwald. "Today, people are far more likely to recognize the need to scale back some of their retirement expectations while stepping up their saving and responsible financial planning."

AIG Life and Retirement is one of the largest life insurance and retirement services organizations in the United States.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.