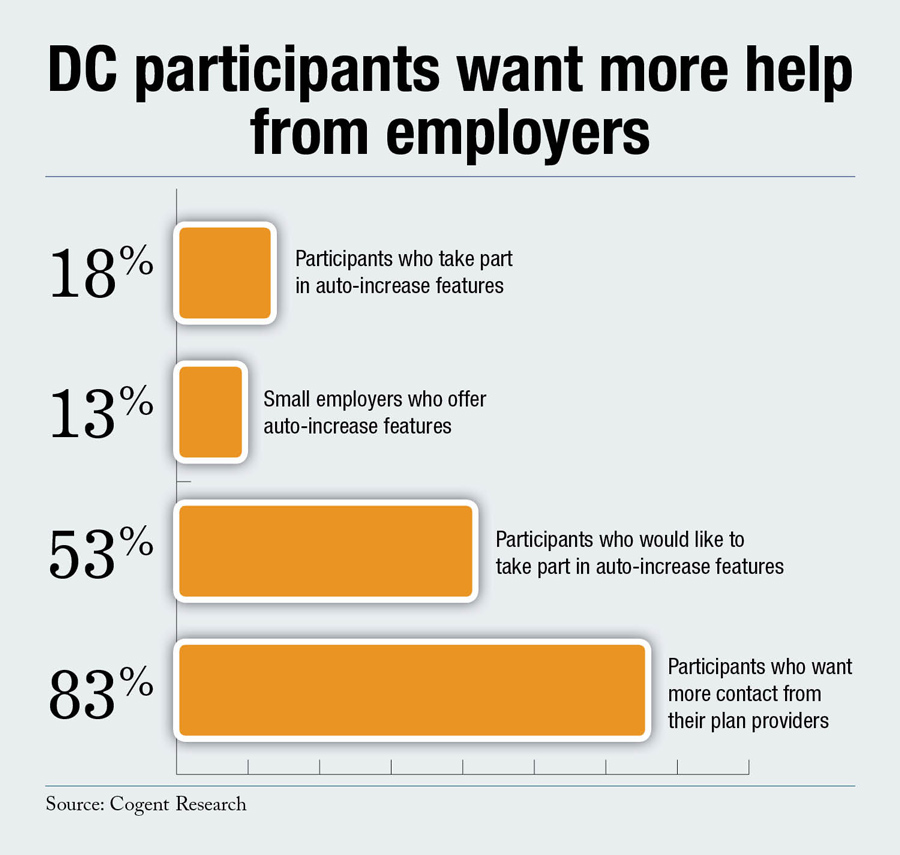

According to Cogent Research, nearly half of plan participants report wanting access to contribution auto-increase—a feature that automatically raises the contribution percentage by a specified amount on an annual basis. Regardless of the size of their employer or the financial services firm managing their plan, interest levels remain high. Unfortunately, a mere 18 percent of Americans with retirement plans say they are taking advantage of such a feature.

Part of the problem lies with access to the feature – particularly at the smaller end of the retirement market. Only 13 percent of the smallest employers are offering the feature to their plan participants, a figure that pales in comparison to the 53 percent of employees of small business who say they want access to the feature.

Recommended For You

"Plan participants are increasingly aware of the fact that their 401(k) or 403(b) will make up the lion's share of their retirement assets, and they want help doing the right thing," said Marie Rice, research director at Cogent Research.

Among large employers, however, the story is quite different. Nearly half of all employers with 1,000-plus employees say they offer contribution auto-increase, a number that matches interest levels among their employees (51 percent). However, only 19 percent of Americans tied to plans offered by large employers say they are currently enrolled in such a program.

"For small employers, the issue is a lack of access to this feature. However, for larger employers, the issue is more a lack of awareness that this feature is in place to help them," said Christy White, principal of Cogent Research. "Larger employers need to do a better job of getting the word out."

White suggests leveraging the support of plan providers who are well equipped to get the message out, particularly given plan participants' interest in hearing more often from the financial services firm their employer has chosen to manage their assets. An astounding 83 percent of plan participants surveyed by Cogent Research for the study indicated that they want to hear from the plan providers more often.

"Plan sponsors and plan providers need to partner together and take up the torch to boost usage of a feature that can really make a difference when it comes to Americans' ability to reach their retirement goals," said White.

Cogent Research surveyed 4,926 Americans with a defined contribution plan. Data was collected in the fall of 2012 via a web survey.

Cogent Research helps clients gain clarity, obtain perspective, and formulate direction on critical business issues.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.