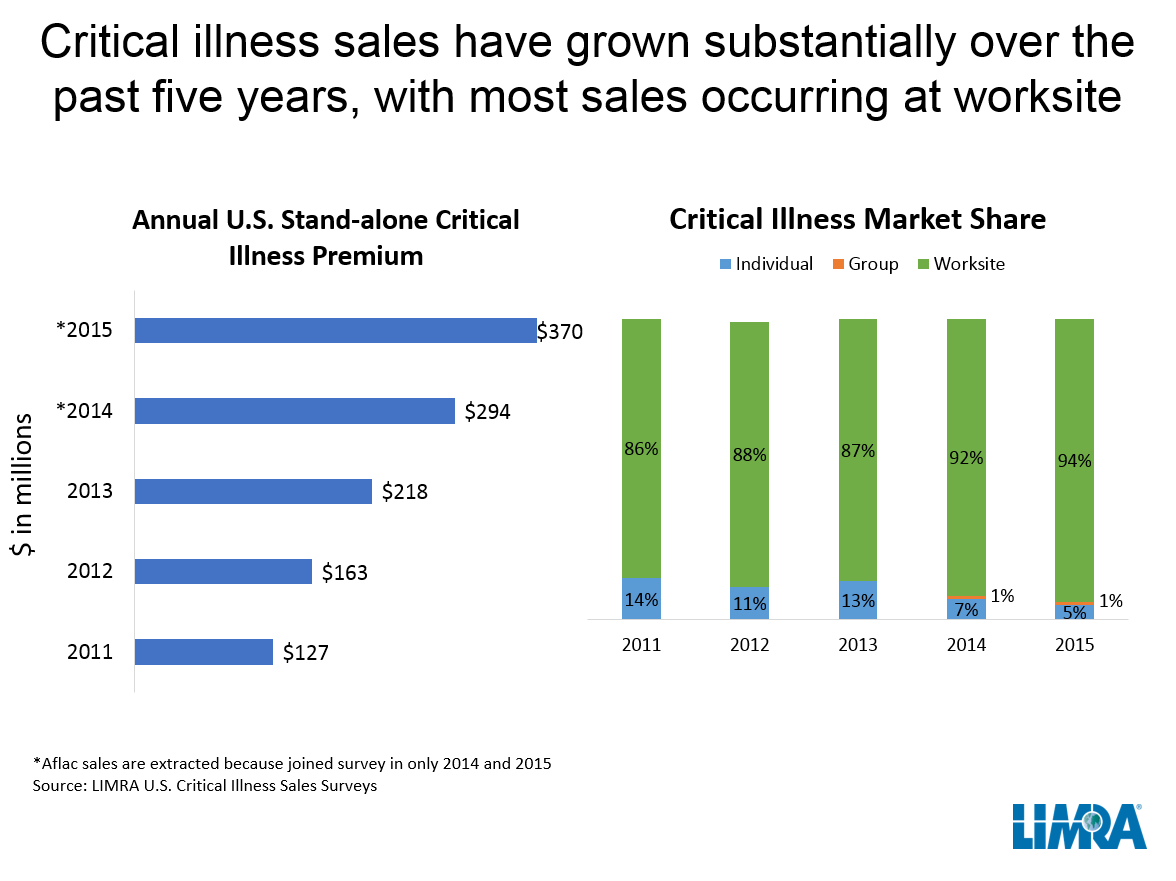

In recent years, insurance companies were quite optimistic about critical illness plans, since the industry showed almost 20 percent increases in new premiums annually. Yet, according to LIMRA's research, less than a quarter of private employers offer CI plans, and the workplace participation rates are in single digits. So, what is really growing CI premiums or the number of employees who purchase coverage? Are we actually witnessing a growth in consumer interest in CI products that will eventually create a long-term potential for CI sales?

LIMRA conducted a series of focus groups to examine what employees understand about CI when they decide whether or not to purchase the benefit. While the focus was on employees, the results of the conversations are also true about the general population. We found that most individuals have limited knowledge of what CI is and mistakenly believe that this is some sort of medical insurance — a resource they can utilize only to pay for their medical bills. This creates a "mistaken identity" for CI, and profoundly shapes consumers' attitudes towards CI insurance. The result of their decision is based off of CI misconceptions built into the decision process.

Here's an idea at what that process might look like:

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.