The role of third party administrators (TPAs) continues to expand. Today, the average TPA not only builds and maintains relationships with brokers who rely on them to keep clients happy and manage the details, they also have to work closely with employers who increasingly expect high levels of service and results for their employees. TPAs must also work directly with employees and navigate their expectations as they eagerly expecting reimbursement for medical claims.

The role of third party administrators (TPAs) continues to expand. Today, the average TPA not only builds and maintains relationships with brokers who rely on them to keep clients happy and manage the details, they also have to work closely with employers who increasingly expect high levels of service and results for their employees. TPAs must also work directly with employees and navigate their expectations as they eagerly expecting reimbursement for medical claims.

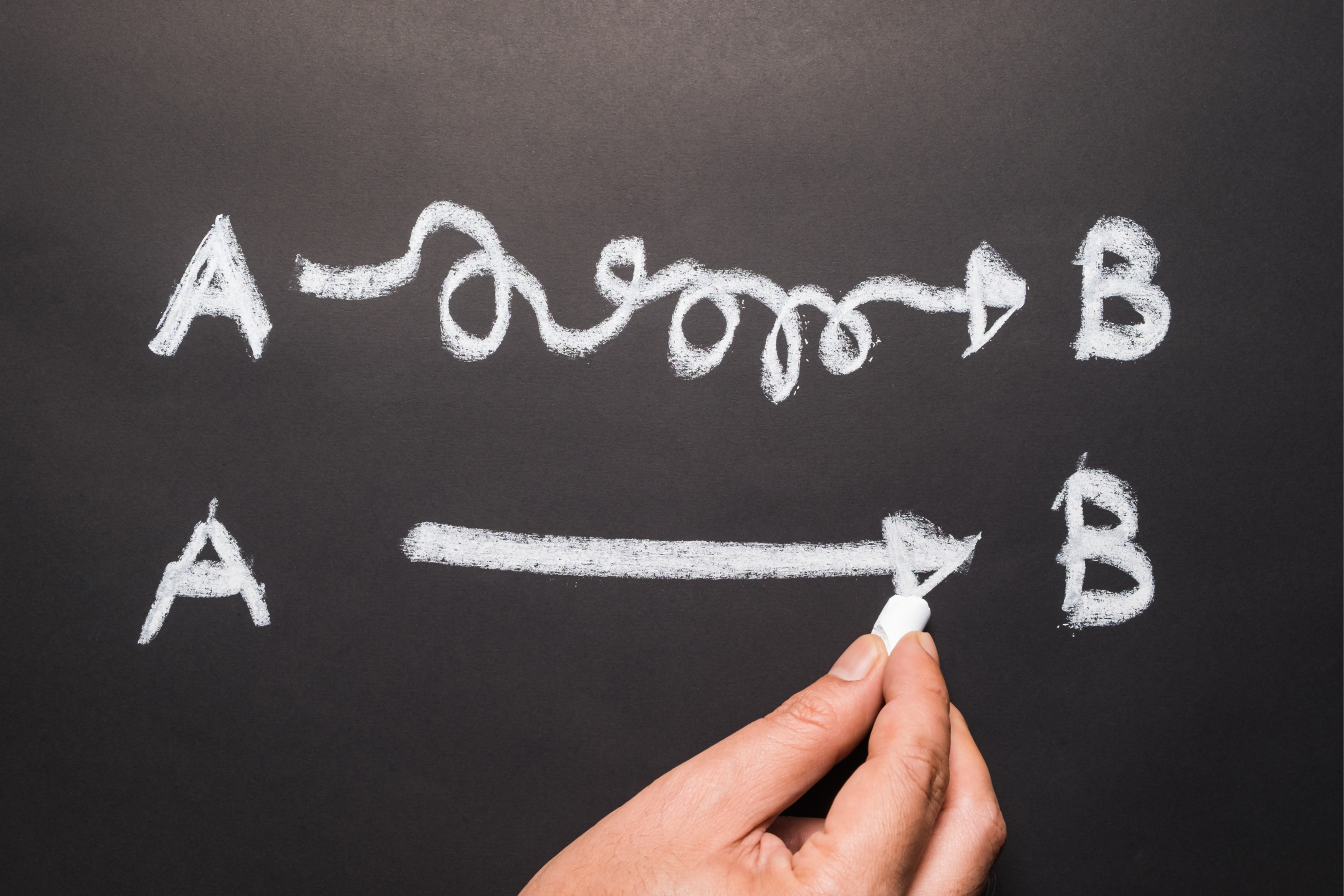

This great balancing act is on top of their actual day-to-day workload. While TPA inefficiency may seem systemic and endemic to the industry, its actually a two-fold problem that includes the TPA's internal processes. One of the biggest aspect of a TPA's workload, explanation of benefits (EOB) processing, is rife with challenges that may feel like the norm, but can and should be addressed.

Industry inefficiency leads to processing inefficiency

According to The Commonwealth Fund, healthcare administration is one of the most inefficient aspects of the U.S. health care system, a system which already ranks far behind other countries.

Whereas other systems and companies standardize their benefits packages for easier and simpler administration, our doctors, patients, and insurance companies are caught in a constant state of back-and-forth, leading to ever-higher administration costs.

Related: Eliminating silos: How TPA integration removes friction

TPAs are stuck right in the middle of this inefficiency, which makes day-to-day operations and responsibilities more tedious and time-consuming. As TPA inefficiency increases, it becomes harder to maintain the important relationship aspect of the business and consistently show timely EOB processing results and performance.

Streamlining tasks is often shortsighted

There are a number of tools available in the marketplace to help TPAs, each with their own business functions, everything from EOB processing and capture to various billing and accounting functions. But do they really help TPAs in their day-to-day operations?

An EOB automation solution may retrieve necessary information, but what happens next? Saving time in the workload process by automatically retrieving the EOB is certainly helpful, but there's more work to do than gathering documentation alone. Additional steps require submitting this information for substantiation and reimbursement, which can be equally as time-consuming if left to be done manually, as is often the case.

Beyond EOB processing itself, how is information getting into the benefits administration system? How does the necessary information get to the right party? Is this part of the work still manual, and therefore, inefficient? Oftentimes, TPAs focus on automating one part — such as EOB processing — and overlook the many other areas where automation could save significant time and money.

This is particularly important toward the end of the year, when participants are under a time crunch to get certain medical expenses reimbursed. If only half the process is automated, only half the challenge has been solved, and TPAs and other administrations will still feel the pressure when year-end comes around and claims start piling up.

Remember the bigger picture

At the end of the day, TPAs own their own businesses, just like the brokers and employers they work with. Their profitability is tied to the ability to offer efficient EOB processing and other services. That profitability extends beyond the EOBs themselves, too.

The solution for busy seasons isn't staffing up with claims specialists; it's using technology to offload as much of the manual and clerical work as possible. This allows them to focus on strengthening relationships with brokers, employers, and participants. Customer satisfaction across all three of these key audiences is itself a tool in the sales kit, and must be protected through efficient and automated EOB harvesting.

The health care industry is in a constant state of change. Employers are changing plans, and more people are receiving care as the U.S. population continues to age. This means that something as seemingly simple as EOB processing can become a critical differentiator for TPAs, and serve as a key growth and success metric. There are ways to address processing inefficiencies, and TPAs who do will find they can increase customer satisfaction levels while more accurately providing benefits.

Jacob Sheridan, co-founder and CEO, TPA Stream

Jacob is the co-founder and CEO of TPA Stream, a leading health administration platform. In this role Jacob oversees company growth and investment, helps lead product development and works directly with customers to help save them time and eliminate manual workloads. Jacob brings over a decade of experience to TPA Stream, leveraging deep experience in technology to help individuals, employers, brokers and third party administrators streamline and simplify healthcare administration challenges.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.