Five health systems have banded together to explore whether a recent proposal from the Centers for Medicare and Medicaid Services might upset their billing system.

Five health systems have banded together to explore whether a recent proposal from the Centers for Medicare and Medicaid Services might upset their billing system.

Is the shadowy world of health system chargemasters about to see a few rays of the light of day?

It could happen. Under pressure from many sides to reveal true costs of services, a group of systems is considering opening up a bit. At this point, they appear willing to talk about how chargemaster prices are set, and how they may adjust them. They are doing so because they fear Medicare may change its reimbursement methodology in a way that would not fully reimburse them.

Related: Unraveling the complexity of our health care billing system

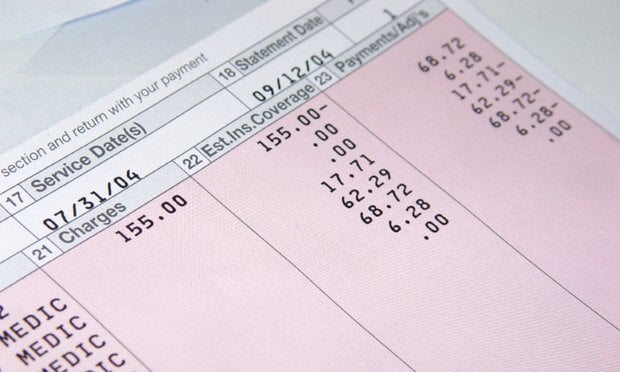

The hospital chargemaster is the list kept by each health system of the reference price for each procedure and service. Chargemasters are unique to each system, and closely guarded. When invoicing a patient (or payer/insurer) for a health care activity, hospital personnel consult the phone-book-like list as a starting point for choosing a value. Prices listed are essentially the hospital's version of reference-based pricing, in that the corresponding number is generally only a starting point for billing. They charge different payers different rates in their attempt to balance the full payers against those who pay less, or nothing, for services.

"Hospitals use their chargemaster prices to negotiate reimbursement rates with private payers. And most patients do not see the chargemaster price from their hospital encounter unless they are uninsured and must actually pay the chargemaster rate," said a 2018 article in RevCycle Intelligence. "Consequently, hospitals tend to set chargemaster prices to remain competitive and negotiate higher rates from private payers. As a result, their prices are usually significantly higher than actual costs of care."

The article notes that few patients or insurers are permitted to see the chargemaster list. However, because Medicare does have access to it to set reimbursement rates, Medicare has been basing reimbursements on a percentage of the chargemaster rate.

Five health systems have banded together to explore whether a recent proposal from the Centers for Medicare and Medicaid Services (CMS) might upset the system. The five: AdventHealth, Geisinger Health System, SSM Health, Trinity Health and Health Resources. They created the Chargemaster Alternatives for Medicare Payment Alliance over concerns that, if they lowered chargemaster prices, Medicare might not adjust its reimbursement rate to recognize the adjustments.

Again, pressure from the outside is behind their coalition. Critics of the wildly varying prices charged by systems for the same procedure has led to pressure to reveal chargemaster rates and actual invoiced bills. The Centers for Medicare and Medicaid Services (CMS) released a price transparency proposal in July (Medicare Outpatient Prospective Payment System) that would force hospitals to release more information on what they actually charge patients.

It appears that the proposal triggered the alliance's formation. The coalition members don't want to lose out on any Medicare dollars because of chargemaster reductions, and they have submitted lengthy comments to the proposal for CMS's consideration. Of course, they also do not want to have to make their chargemaster lists public either. But that may be a fight they can no longer win.

Read more:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.