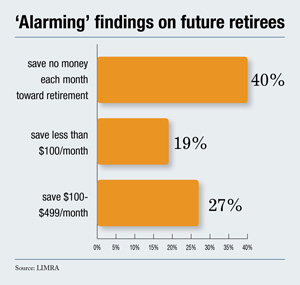

Forty percent of Americans over the age of 18 and not yet retired save no money each month toward retirement, according to an eNation survey, conducted on behalf of LIMRA Retirement Research in October.

The report also found that 19 percent of adults not yet retired typically save less than $100 per month, while 27 percent of consumers save $100 to $499 per month. Forty-two percent of households with incomes over $50,000 a year were saving $100 or less or nothing for retirement each month.

The report also found that 19 percent of adults not yet retired typically save less than $100 per month, while 27 percent of consumers save $100 to $499 per month. Forty-two percent of households with incomes over $50,000 a year were saving $100 or less or nothing for retirement each month.

"These findings are alarming," said Matthew Drinkwater, associate managing director of LIMRA Retirement Research. "Our research indicates that fewer future retirees will have pensions to pay for their living expenses and more will be relying on their personal savings to fund their retirement. Without a significant change in savings behavior, many Americans will not have enough money to afford to retire."

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.