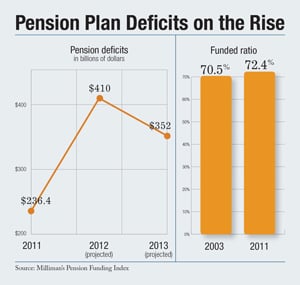

Milliman's Pension Funding Index showed that the 100 large defined benefit pension plans it tracks increased their pension deficit by $236.4 billion in 2011, as corporate pensions faced record underfunding.

In December alone, these pensions experienced a $59.7 billion decrease in pension funded status. The funded status decline for the month of December was primarily due to higher liabilities based on a decrease in corporate bond interest rates that are the benchmarks used to value pension liabilities. The funded status decline was partially offset by positive investment performance during December.

"This was an unusually dispiriting year for these 100 pensions," said John Ehrhardt, co-author of the Milliman Pension Funding Study. "Assets treaded water this year, producing an anemic $12.3 billion increase in value as record low interest rates increased pension liabilities by $248.7 billion."

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.