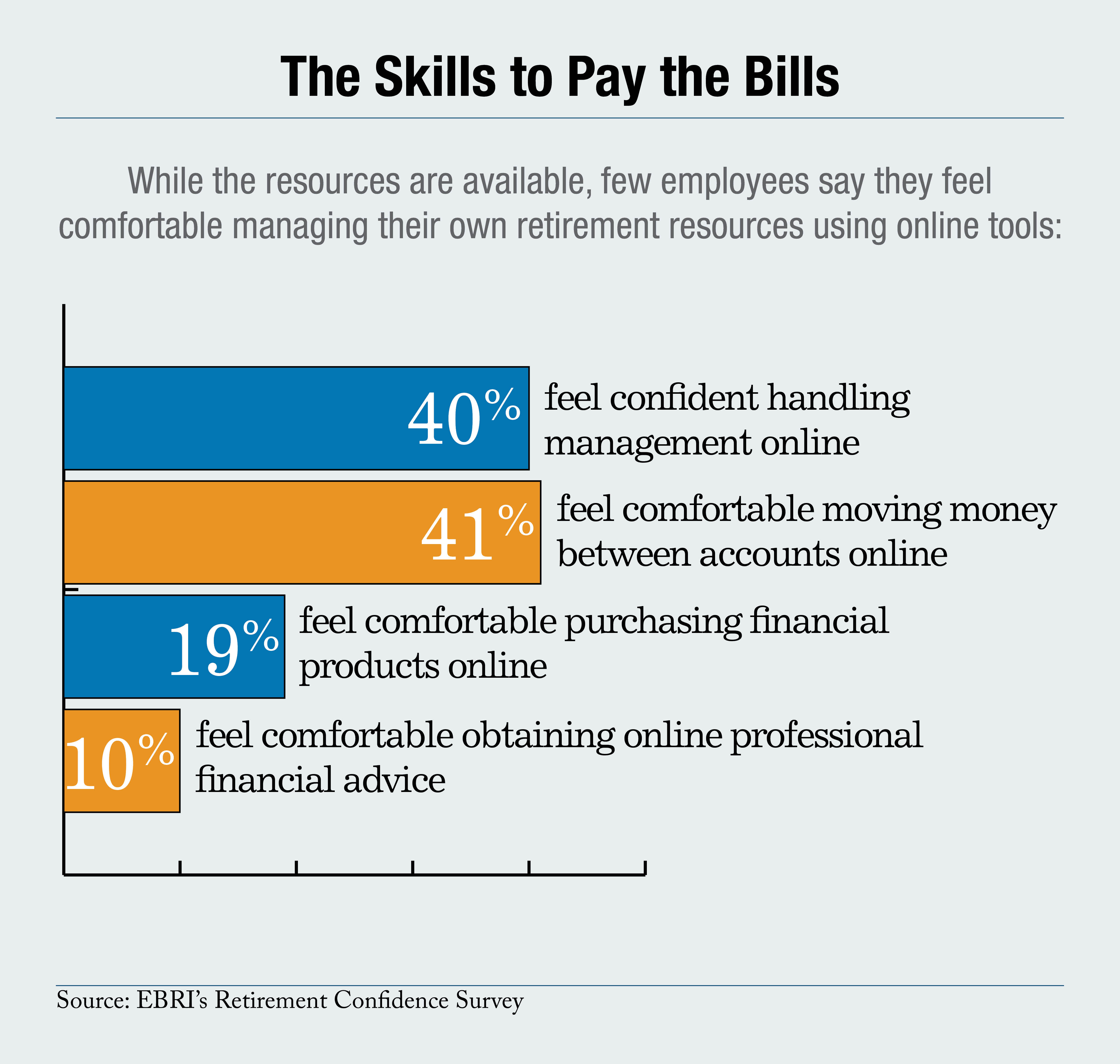

Job uncertainty, debt and financial insecurity are fueling Americans' fears that they will not be able to retire comfortably. According to the Employee Benefit Research Institute's 22nd Retirement Confidence Survey, the percentage of workers saving for retirement continues to decline and many remain uncomfortable using new technologies to help them manage their finances.

Tom Clark, president of Lockton Investment Advisors, LLC, in Washington, D.C., said that most of the report's findings didn't shock him, but one thing that did surprise him was the comment that only a "minority of workers feel comfortable using online technologies to perform task-related financial management. When you look at the usage statistics for our clients, over and over again the percentage of participants that do anything to move money around or change deferrals or review their accounts are doing it online, regardless of what industry they are in," he said.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.