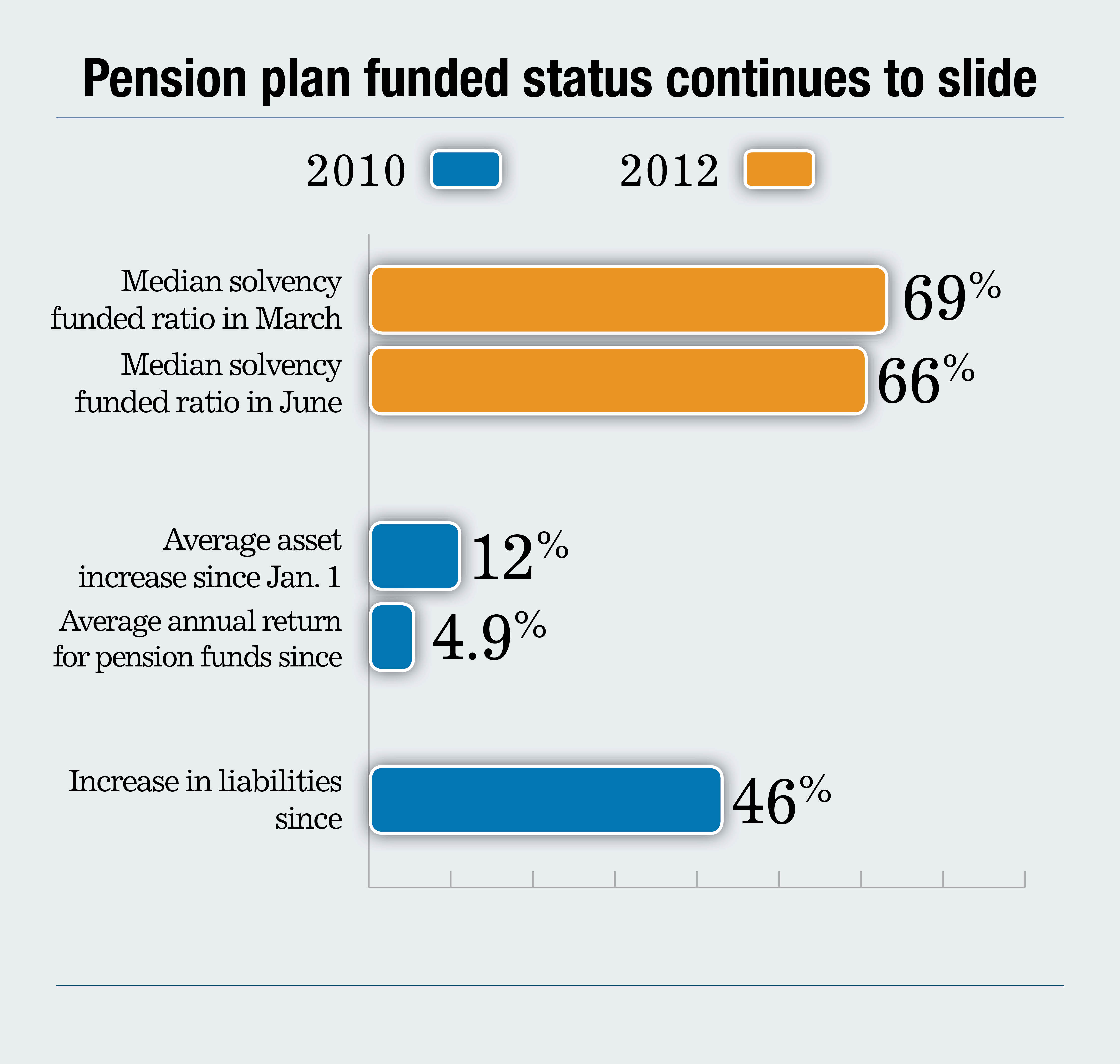

The financial status of pension plans continued to deteriorate in the second quarter of 2012. Negative equity returns and a decrease in interest rates were the main reasons for the slide, according to Aon Hewitt. The median solvency funded ratio for a large sample of pension plans has decreased from 69 percent at the end of March 2012 to 66 percent at the end of June 2012.

Despite significant cash contributions to pension plans this year, the funding position of plans has still gone down from the beginning of the year.

About 97 percent of pension plans in this sample had a solvency deficiency. The solvency funded ratio measures the financial health of a defined benefit pension plan by comparing the amount of the assets to total pension liabilities in the event of a plan termination.

About 97 percent of pension plans in this sample had a solvency deficiency. The solvency funded ratio measures the financial health of a defined benefit pension plan by comparing the amount of the assets to total pension liabilities in the event of a plan termination.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.