A large amount of Gen Xers and Boomers are falling behind in their goal of a secure retirement. New research by the Insured Retirement Institute shows that these two groups, especially, do not have enough saved for retirement, lack investment knowledge and have not taken important retirement planning steps, such as calculating a retirement savings goal or consulting with a financial professional.

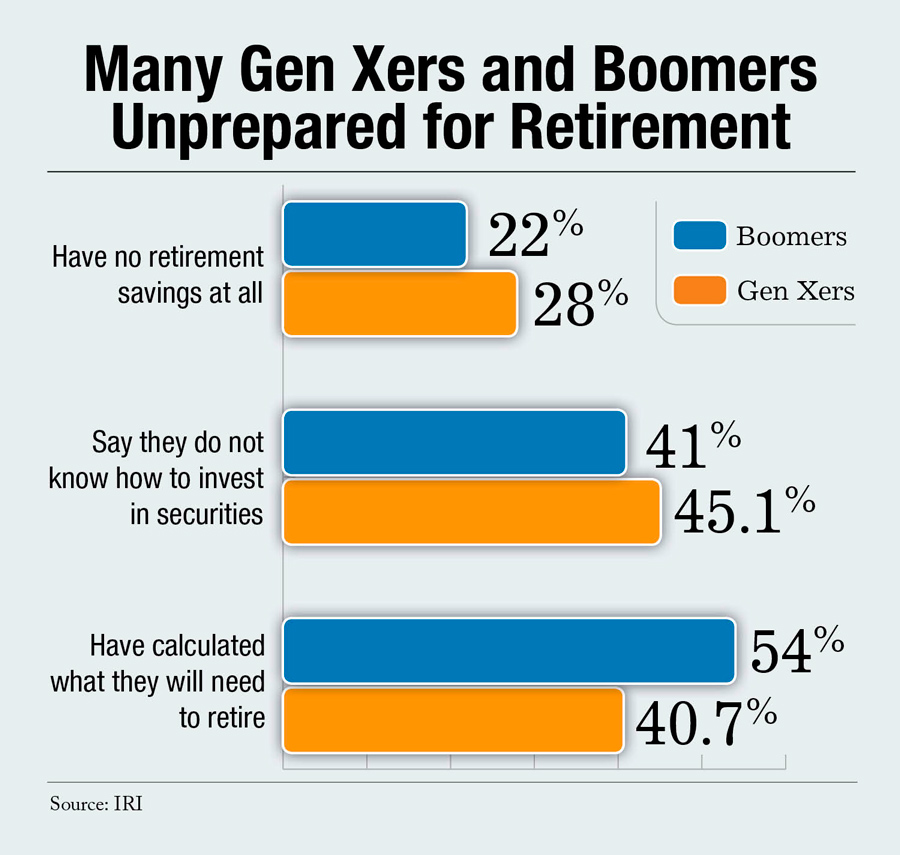

Nearly 22 percent of Baby Boomers and nearly 28 percent of Gen Xers have no retirement savings. Of those who have saved and indicated their savings levels, nearly 40 percent of Boomers and about two-thirds of Generation X have less than $100,000 saved for retirement, according to the IRI data.

Nearly 41 percent of Boomers and 45.1 percent of Generation Xers reported that they are not very or not at all knowledgeable about investing in securities. Many have not calculated how much they will need to retire. Only 51.4 percent of Boomers and 40.7 percent of Gen Xers have done the math. Nearly 53 percent of Boomers and nearly 63 percent of Gen Xers have not consulted with a financial advisor.

Nearly 41 percent of Boomers and 45.1 percent of Generation Xers reported that they are not very or not at all knowledgeable about investing in securities. Many have not calculated how much they will need to retire. Only 51.4 percent of Boomers and 40.7 percent of Gen Xers have done the math. Nearly 53 percent of Boomers and nearly 63 percent of Gen Xers have not consulted with a financial advisor.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.