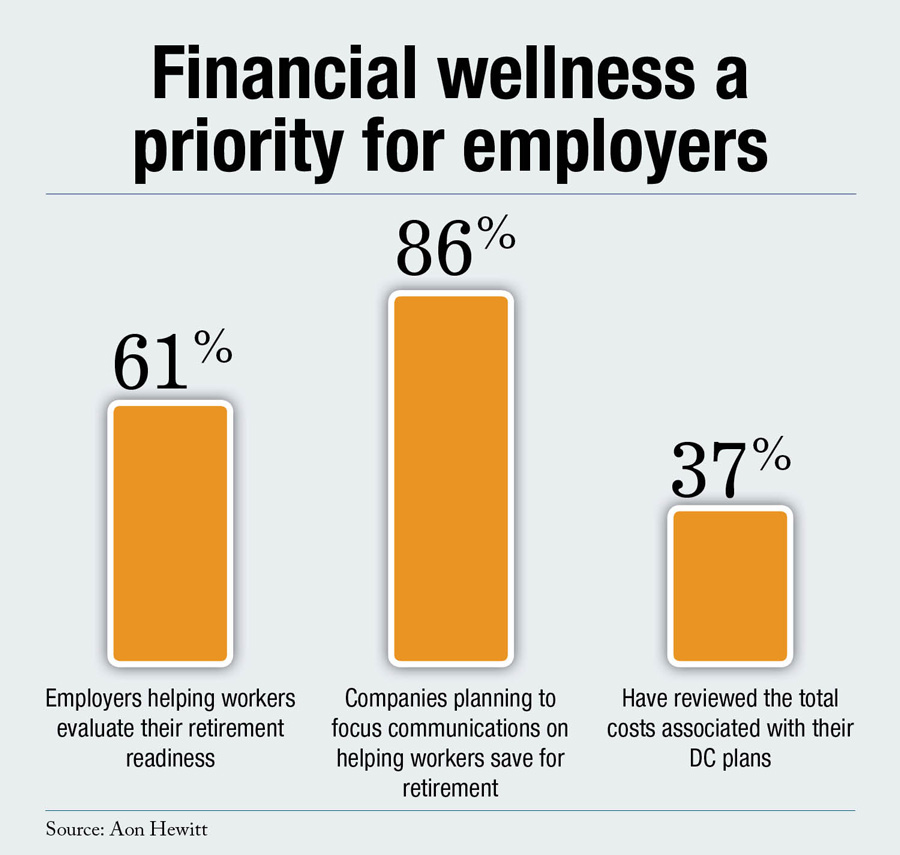

Employers are making the improved financial wellness of their employees a priority in 2013.

A new survey by Aon Hewitt, the global human resources solutions business of Aon plc, found that to help employees save and prepare for retirement, employers are taking steps to ensure workers understand the financial resources they need to retire, while also offering more sophisticated defined contribution plan features that make investing easier and more accessible.

Aon Hewitt surveyed more than 425 U.S. employers, representing 11 million employees, to determine their current and future retirement benefits strategies. According to Aon Hewitt, workers need 11 times their final pay to meet their financial needs in retirement, but the average U.S. worker has a savings shortfall of 2.2 times pay.

Aon Hewitt surveyed more than 425 U.S. employers, representing 11 million employees, to determine their current and future retirement benefits strategies. According to Aon Hewitt, workers need 11 times their final pay to meet their financial needs in retirement, but the average U.S. worker has a savings shortfall of 2.2 times pay.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.