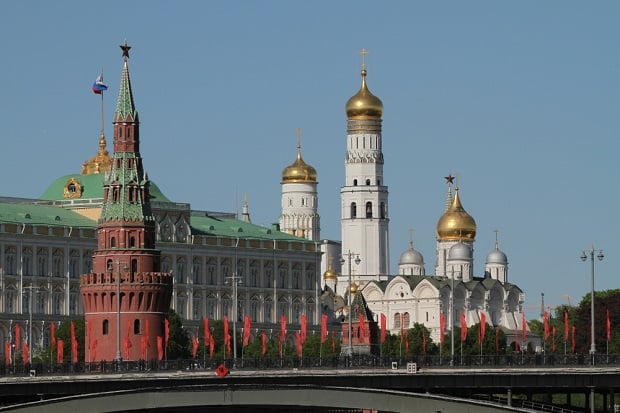

The holdings in America's largest pension expose a dilemma for lawmakers who are considering ways to penalize Russia for alleged election meddling. (Photo: Shutterstock)

The holdings in America's largest pension expose a dilemma for lawmakers who are considering ways to penalize Russia for alleged election meddling. (Photo: Shutterstock)

(Bloomberg) –An escalating war of words between Russia and the U.S. didn't prevent a chunk of pensions that belong to Californian firefighters and police officers from finding its way into debt sold by President Vladimir Putin's government.

$460 million invested

The California Public Employees' Retirement System, or CalPERS, had about $460 million invested in Russian government bonds as of the end of June, up over 8 percent since last year, according to data provided to Bloomberg News.

Based on publicly disclosed figures, that makes the state of California Russia's 10th-largest foreign creditor, behind other top U.S. investors including BlackRock and Stone Harbor Investment Partners.

In the sanctions standoff between Russia and the U.S., the vulnerability goes both ways after two years of inflows from carry traders briefly turned Russian debt into an investor darling.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.