Brokers today are moving away from a single point solution for health care to menu of solutions that, hopefully, provide a better experience at a lower cost. (Photo: Emily Payne/ALM)

Brokers today are moving away from a single point solution for health care to menu of solutions that, hopefully, provide a better experience at a lower cost. (Photo: Emily Payne/ALM)

Brokers talk a lot today about cutting ties with the carriers. What does that mean? It means they're not selling a single point solution to cover all of an employer's health care needs. Instead, they're selling a menu of solutions that, hopefully, provide a better experience at a lower cost than a traditional health plan.

“When you think about the term 'creative plan design,' our minds automatically and historically go to deductible, copay, network,” Josh Butler of Butler Benefits and Consulting explained to attendees of a session at the recent BenefitsPRO Broker Expo. “Health care is not the same as health insurance. At the end of the day, if you ask people what they really want, they want health care. They want transparent, good quality, fairly priced. You don't necessarily need health insurance.”

Butler was a panelist for the session, “How to help employers reduce costs and improve outcomes with creative plan designs.” He was joined by Bret Brummitt of AG Insurance Agencies and Rachel Miner of Thrive Benefits, and hosting the discussion was Q4i's Wendy Keneipp.

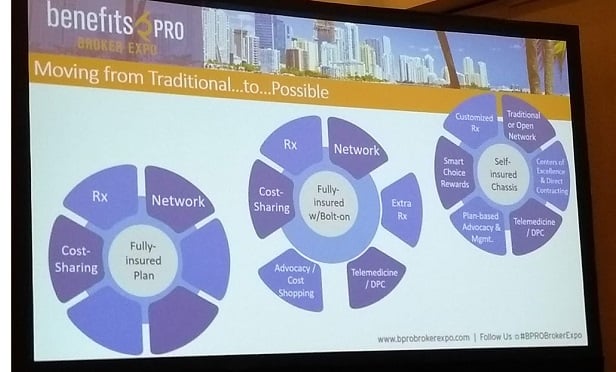

Setting the stage for their discussion, Keneipp described the journey that many brokers and their clients are taking from fully insured to self-insured: “We start out at the far end, fully insured plans. From there, we look at how can we help our clients who are not yet ready to make a bigger move and gradually move them over time into something that is a little more sophisticated and help employees become more engaged in the plan. From there we move to a self-insured chassis. It allows you to create a traditional self-insured plan or deconstruct it and bring in each of the individual pieces you want.”

Sounds daunting, doesn't it? That's because it is. There are numerous obstacles to overcome. Thankfully, Brummitt, Butler and Miner were willing to share the obstacles they've encountered (or as many as they could cover in 45 minutes) and how to overcome them.

Obstacle 1: The employer

“Change can be beautiful, change can be painful. Most of the time it's both.” This is how Miner starts conversations about implementing a new plan design, hitting on the crux of the issue for everyone involved. Employers, though they may not like seeing their health care expenses rising year after year, would often rather stick with the devil they know than take a risk on something new.

Like anything else, though, the right incentive will help open their mind. “You're taking something that's not the norm, and to execute well, you have to have some kind of reward in it,” Brummitt said. “Some kind of financial component or ROI to get the employer to buy in. I have to show some kind of reward to the employer from the cost standpoint.”

Focusing on cost savings will certainly warm them to new ideas, but beware of choking the flame before it can grow. “A huge pitfall for us and anyone out there: doing too much too fast,” Butler cautioned. “You're so excited to get in there and tell them every solution you have, and you throw it up on the table. But we've spent the better part of two years learning value-based insurance design. These clients we have are discussing benefits an hour and a half once a year.”

Getting a feel for what a company wants to accomplish and their appetite for change will put everyone on the same page and help guide the process. “I always ask companies what is the goal of the plan?” Miner said. “Do they want to have cost savings, control costs for employees, an enhanced plan for next year? We can do it all at once, we can do it slowly. I look at the company culture and see how they can adopt it.”

Rachel Miner, Josh Butler, Bret Brummitt and Wendy Keneipp discussing creative plan design at the BenefitsPRO Broker Expo.

Rachel Miner, Josh Butler, Bret Brummitt and Wendy Keneipp discussing creative plan design at the BenefitsPRO Broker Expo.Obstacle 2: The employees

No creative plan design will work if it doesn't have employee buy-in. “The employee has to be the one to execute the plan design structure,” Brummitt said. “Any good design will fail if it's put into the hands of someone who doesn't share that central goal.”

That said, there is one key ally who can make or break the success of any new solution: the HR department. “We hear, you just have to talk to the C-Suite, forget the HR person,” Miner said. “But the HR person is going to be the one dealing with the employee who comes in crying because their child can't afford to go see a neurologist.”

Listen to and address the concerns of the HR department, and then ask for their help in crafting the right communication strategy for employees. “You hear a lot about education,” Butler said. “One mistake we often make: We're very eager to go and implement solutions, but we haven't got a well-thought-out communication strategy.” Butler stresses the need to make benefits education and communication a year-round process, not just something done during open enrollment.

But how do you get employees to actually listen to the message? Brummitt has an interesting tactic: his fictitious mystery boil. “I take this ridiculous thing and put it into a real life situation,” he explained. “My mystery boil goes to the doctor's office. My mystery boil gets sent off to the labs, goes to CVS pharmacy for treatment. I use this cartoonish feature to sink that earworm into the communications piece.”

Also effective is hitting on that key issue of what's in it for the employees. “I talk to employees about how they do not want to be paying their maximum out-of-pocket,” Miner said, adding that she often shares the story of her own health care journey and the resulting expenses. “I've had four years in a row where I've hit my max out-of-pocket. It's not fun. People buy from people they like. It's the same thing; we're selling the changes to the employees. If I can say, 'I've been in your shoes, this is why I want to help you,' it resonates with people.”

Obstacle 3: The vendors

One of the hardest, or most time consuming parts of building a plan from the ground up is the influx of new vendors offering product solutions with which to build those plans. ”It's hard to know from the solution provider to sales pitch to end result where that path works the way it's supposed to and where it may not,” Brummitt said. “And do you even understand what someone's selling you? Some of these things are not even easy to understand from the get-go.”

Miner offered her checklist for working with new vendors: create an RFP process, require references, ask for a performance guarantee, and look for overlaps with current vendors. It's vital to thoroughly vet any new products before recommending them, Brummitt agreed, both by talking with happy and unhappy clients as well as getting feedback from a peer group. “Without that, you're playing learning lab with your client-employees' lives,” he said. “That's not a fair thing.”

And remember, as the consultant who recommended the vendors, you're also going to be the face of any problems the employer faces. “I did not, at that point in time, understand the value of that vendor becoming the face of the problem or the service,” Brummitt said, recalling one particularly bad experience. “It was still pushed back on me. I did not make the proper introduction or handoff. When you take something from a boxed solution to unbundled, there's a different level of service provider experience… you can't be the face of something you can't fix.”

As a final note, consider the reaction your employer client will have when you show them the new list of vendors and products replacing their traditional health care plan. “You can show savings in the plan, but a lot of time it gets overlooked,” Butler said. “Even if they are still overall saving money, if it makes the administrative process a lot harder and they feel like they're getting nickel and dimed, that needs to be addressed. Streamline it to make it an easy, single point billing.”

Read more of our Expo coverage:

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.