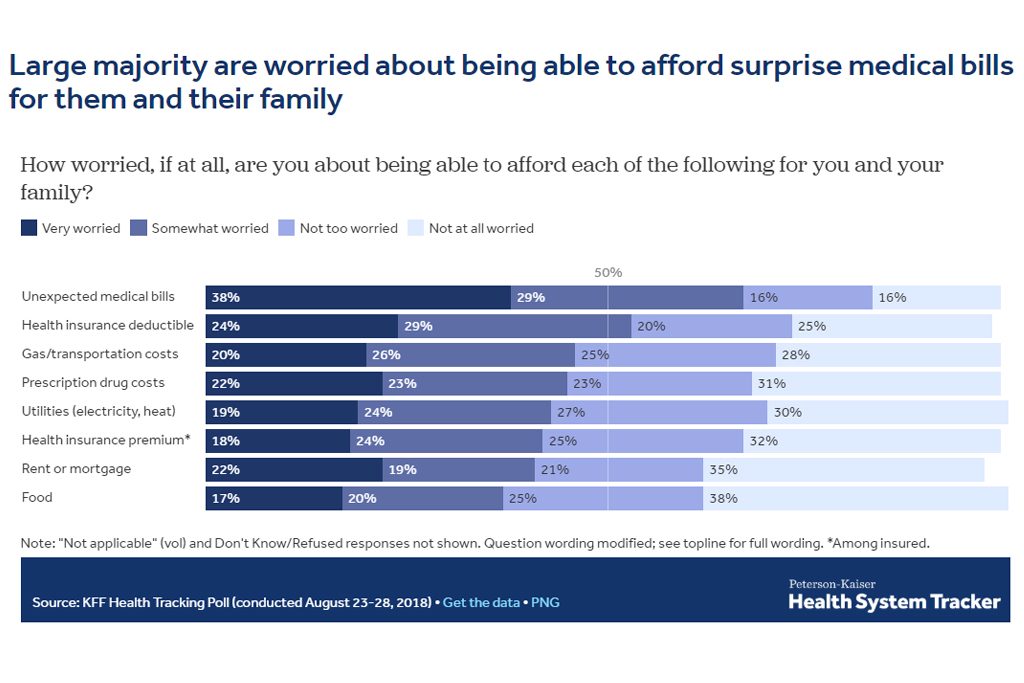

Surprisemedical bills are top of mind for American patients, with 38percent reporting they were “very worried” about unexpected medicalbills.

Surprisemedical bills are top of mind for American patients, with 38percent reporting they were “very worried” about unexpected medicalbills.

About 1 in 6 Americans were surprised by a medical bill aftertreatment in a hospital in 2017 despite having insurance, according to a study published Thursday.

|On average, 16 percent of inpatient stays and18 percent of emergency visits left a patient with atleast one out-of-network charge. Most of those came fromdoctors offering treatment at the hospital, even when the patientschose an in-network hospital, according to researchers from theKaiser Family Foundation. Its study was based on large employerinsurance claims. (Kaiser Health News is an editorially independentprogram of the foundation.)

||The research also found that when a patient is admitted to thehospital from the emergency room, there's a higher likelihood of anout-of-network charge. As many as 26% of admissions from theemergency room resulted in a surprise medical bill.

|“Millions of emergency visits and hospital stays left peoplewith large employer coverage at risk of a surprise bill in 2017,”the authors wrote.

|Related: California takes aim at surprise billing foremergency services

|The researchers got their data by analyzing large-employerclaims from IBM's MarketScan Research Databases, which includeclaims for almost 19 million individuals.

|Surprisemedical bills are top of mind for American patients, with38 percent reporting they were “very worried” aboutunexpected medical bills.

|Surprise bills don't just come from the emergency room. Often,patients will pick an in-network facility and see a provider whoworks there but isn't employed by the hospital. These doctors, fromoutside staffing firms, can charge out-of-network prices.

|“It's kind of a built-in problem,” said Karen Pollitz, a seniorfellow at the Kaiser Family Foundation and an author of the study.She said most private health insurance plans are built on networks,where patients get the highest value for choosing a doctor in thenetwork. But patients often don't know whether they are beingtreated by an out-of-network doctor while in a hospital.

|“By definition, there are these circumstances where they cannotchoose their provider, whether it's an emergency or it's [a doctor]who gets brought in and they don't even meet themface-to-face.”

|The issue is ripe for a federal solution. Some states havesurprise-bill protections in place, but those laws don't apply tomost large-employer plans because the federal government regulatesthem.

|“New York and California have very high rates of surprise billseven though they have some of the strongest state statutes,”Pollitz said. “These data show why federal legislation wouldmatter.”

|Consumers in Texas, New York, Florida, New Jersey and Kansaswere the most likely to see a surprise bill, while people inMinnesota, South Dakota, Nebraska, Maine and Mississippi saw fewer,according to the study.

|Legislative solutions are being discussed in the White House andCongress. The leaders of the Senate Health, Education, Labor andPensions Committee introduced a package Wednesday that includeda provision to address it. The legislation from HELP sets abenchmark for what out-of-network physicians will be paid, whichwould be an amount comparable to what the plan is paying otherdoctors for that service.

|That bill is set for a committee markup next week.

|Other remedies are also being offered by different groups oflawmakers.

|Kaiser Health News isa nonprofit news service covering health issues. It is aneditorially independent program of the Kaiser Family Foundation,which is not affiliated with Kaiser Permanente.

|Read more:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.