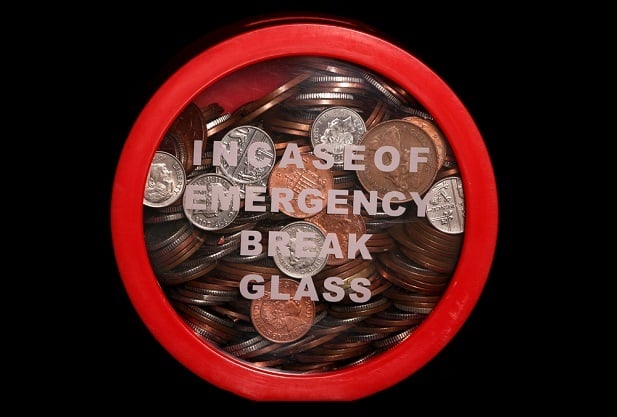

It is now more important than ever for employers to help employees save for a medical emergency, including helping them set up a specific savings fund. (Photo: Shutterstock)

It is now more important than ever for employers to help employees save for a medical emergency, including helping them set up a specific savings fund. (Photo: Shutterstock)

Medical bills drive 530,000 families to bankruptcy each year, as reported by the American Public Journal of Health. It's a sad, frightening state of the economy when the best option Americans have is to declare bankruptcy, or they'd otherwise drown in medical expenses.

It's no wonder; adequate health care coverage is becoming largely out of reach for the majority of Americans. For the first time in history, the cost of family health coverage in the U.S. now tops $20,000. Many employers share a percentage of the health care premiums, but the average contribution for an American worker is $6,000 for a family plan. And this $6,000 premium doesn't include co-payments, deductibles and other forms of cost-sharing when a medical emergency arises.

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.