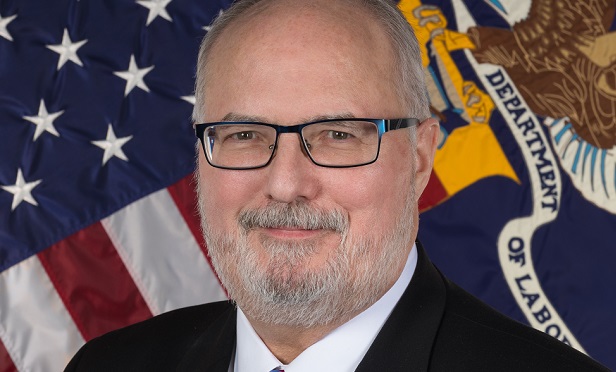

Preston Rutledge, the head of EBSA (Photo: Shawn T.Moore/DOL)

Preston Rutledge, the head of EBSA (Photo: Shawn T.Moore/DOL)

Preston Rutledge, assistant secretary of Labor for the Employee Benefits SecurityAdministration, will leave his post at the end of May. As head ofEBSA, Rutledge has been charged with spearheadingLabor's new fiduciary rule to align with the Securities and ExchangeCommission's Regulation Best Interest.

|As of Friday, that rule had yet to land at the Office ofManagement and Budget for review.

|Labor Secretary Eugene Scalia said in a Friday statement thatRutledge "brought greater security to employees' retirement andhealth care plans, and helped small businesses extend health careand retirement benefits to their workers."

|Rutledge's two-and-a-half years at Labor "are a fitting capstoneon an exceptional 25 years in government service. We will miss hiscounsel, and wish him all the best," Scalia said.

|Brad Campbell, former head of EBSA who's now a partner at FaegreDrinker Biddle & Reath, told ThinkAdvisor on Friday that whileRutledge's departure won't result "in any additional delayto current outstanding projects at EBSA, given the strength of hisdeputy, Jeanne Wilson, and the importance of the agency's missionto current events," Labor's fiduciary rule reboot has been pushedto the back burner.

|"Reproposing the fiduciary rule is not at the top of theDepartment's agenda," Campbell said. "How far down it has slippedonly time and publication of the spring regulatory agenda willtell."

|Moving the final electronic disclosure rule "ahead of theproposed fiduciary rule" makes sense, Campbell added. "That finalrule will likely be completed in time to become a lastingregulation even if President Trump does not win reelection, whilethe proposed fiduciary rule likely will be only partway through theregulatory process by the end of the year."

|Susan Neely, president and CEO of the American Council of LifeInsurers, added in a statement that Rutledge "was a champion ofwhat became the Secure Act from start to finish — first as alegislative architect in the Senate, and then at EBSA."

|Sen. Patty Murray, D-Wash., ranking member of the Senate Health,Education, Labor and Pensions (HELP) Committee, pressed Rutledge in early April to exerciseLabor's new authority provided under the Coronavirus Aid, Reliefand Economic Security (CARES) Act to extend filing deadlines forcertain notice and disclosure requirements imposed by the EmployeeRetirement Income Security Act.

|Read more:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.