Apparently the majority of employees don't understand HSAs, according to recent reports. Is it any wonder? When my employer can publish an over-350-page book with single spaced Q&As about Health Savings Accounts rules and regulations*, you know these

accounts are a little more complicated than they seem. At least on the

employer end. Here's the ultra-basic, bottom-line, bare-bones test for

HSA eligibility -- can the employee meet the following 4 requirements?

- They have to be enrolled in an HSA-eligible health plan such as a high-deductible health plan.

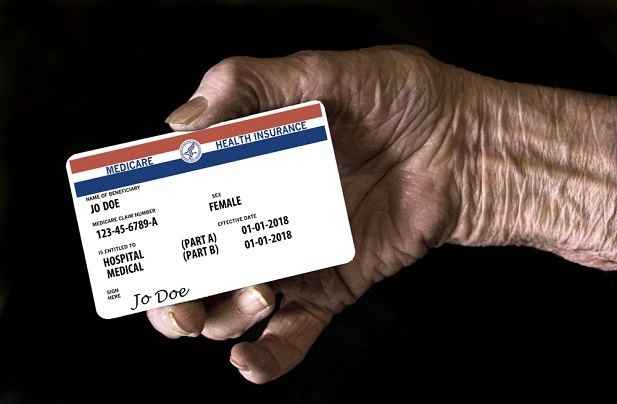

- They must not be enrolled yet in Medicare.

- They cannot be claimed as a dependent on someone else's tax return.

- They must not be covered under another, non-HSA-eligible health plan.

But eligibility might be the easy part of this equation. One of the harder-to-solve parts is the confusion and uncertainty about HSAs. The gallery above shows five common HSA myths, according to a new

whitepaper from the Defined Contribution Institutional Investment Association (DCIIA). Once that's cleared up and the myths are busted, communications can continue. DCIIA has several suggestions about the points employers might want to make with

employees about HSAs:

1. Communicate the triple tax benefits of HSA and what exactly that means: - Employees contribute to an HSA on a pre-tax basis through payroll, reducing their taxable income.

- If employees leave contributions in the HSA, in many cases they can be invested rather than just sitting there in the account, and the earnings grow on a tax-deferred basis.

- Employees can withdraw money for qualified medical expenses without having to account for that on their federal income taxes.

2. Help employees understand how HSAs are different from FSAs: - With an HSA, an employer isn't involved in approving employee expenditures. It's the employee's responsibility for knowing how to spend it -- which, on the positive side, means they don't have to get employer approval on expenditures.

- HSAs are different from FSAs in that there is no "use it or lose it" rule -- the funds can roll over year after year.

- With an HSA, the account and funds stay with the employee if they move to another employer.

3. Help illustrate for employees several typical strategies for spending, saving, and investing with an HSA. HSAs aren't just for spending. Or even saving. But how they are used depends on the employee and their financial and medical circumstances. To get an idea of the various strategies for HSA use, take a look at the figures below from a ConnectYourCare 2018 report cited in the DCIIA whitepaper. These figures show how various HSA owners use their HSA:

- 23% of HSA users use 100% each year (Super-Spenders—spend all of their account)

- 33% of HSA users use 51-100% each year (Spenders—spend most of their account)

- 28% of HSA users use 0.1-50% each year (Savers—save most of their account)

- 16% of HSA users use 0% each year (Super-Savers—save all of their account)

4. Consider auto-enrollment in HSAs. Lastly, if employees are enrolled in an HDHP, DCIIA says, "consider automatically enrolling them in an HSA." It can be a little more complicated than auto-enrolling them in 401(k)s -- but it can be done. Finding an HSA expert can help. But remember, employers are the experts on their employees-- they know their workforce demographics better than anyone else in the benefits world. If employees are already

struggling with putting money into an emergency fund, you know that telling them about the investment features of an HSA could make them roll their eyes or even laugh (if they're kindly people, after you leave the room). You'll know what features resonate with your employees. There is a fair amount of hand-wringing these days about how employees are using HSAs for current medical expenses rather than socking away money to invest. From what I've learned, it's better to have an HSA if an employee is eligible, even if they don't save or invest those funds, rather than not have one at all.

*That book is 2020 Health Savings Account Facts, from National Underwriter. READ MORE: