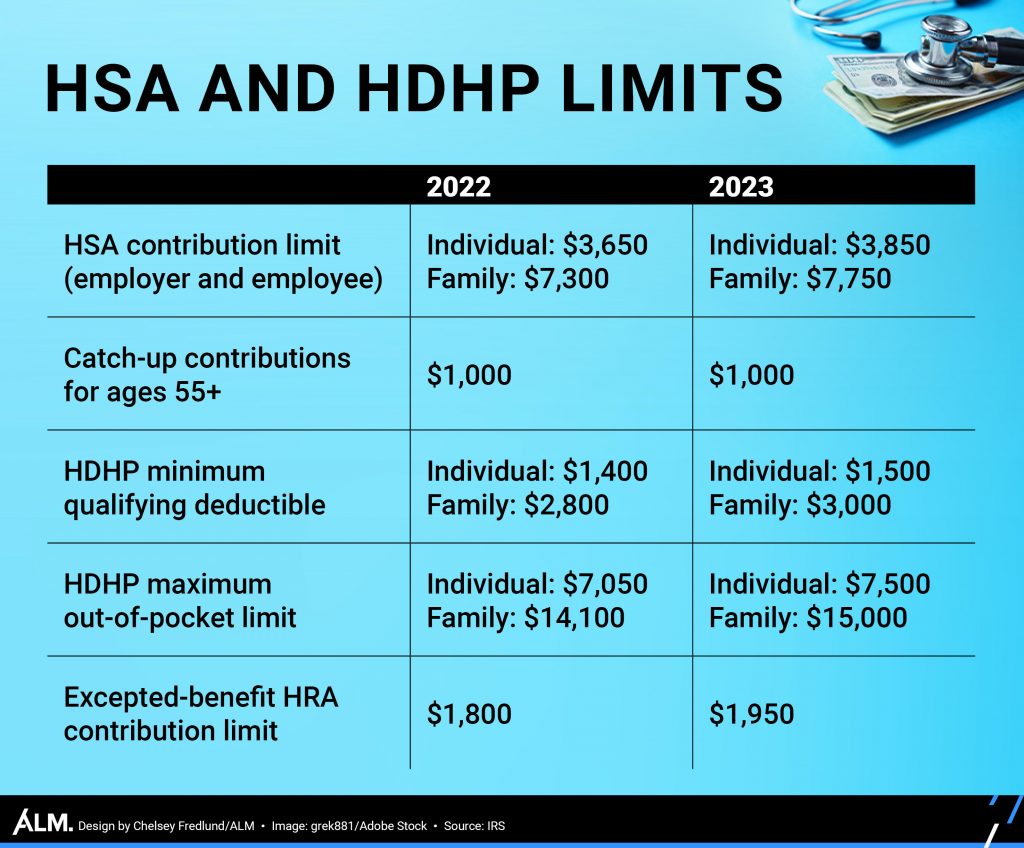

Inflation is driving up prices for just about everything, so it's no surprise that the IRS's 2023 limits for Health Savings Account contributions and high-deductible health plans have also taken a jump.

The increases "are a significant jump, much higher than previous increases on an annual basis," Kevin Robertson, chief revenue officer at HSA Bank told SHRM, adding that it could spark more employers to start matching employees' HSA contributions, "even if it's a nominal amount, a couple of hundred dollars."

Continue Reading for Free

Register and gain access to:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.