The conference closed out with a very popular panel: What's the Real Cost of Rx? And How Do We Fix It?"

Featuring Ali Goodwin, Bill Hepscher, Amanda Brewton, Robert Pfeiffer, Cheryl Larson and Eric Kohlsdorf:

"Misaligned incentives is another way of saying greed. The PBM landscape is becoming a monopoly and turning into a profiteering model. If you can sing the jingle, you can't afford the drug … PBM transparency means nothing until you can verify what they actually mean … Manufacturers don't like that people are starting to look behind the curtain and wondering why some countries pay far less for the exact same drugs…

"The big 3 PBMs own 75% of the market. Independent PBMs aren't competing against each other, we're competing against them … The big PBMs and carriers are enmeshed and there's no longer a way to track where one ends and the other begins … C-suite education is key -- advisors should educate your clients about what's going on. Employers are fiduciaries and need to understand what's happening … How can we possibly expect employees to make good benefit decisions if we don't help with the tools and education they need?"

Jessica Brooks Woods CEO laid out her vision for the association and the benefits industry.

"We're in unprecedented times and it's going to take an unprecedented level of commitment to make a difference …We are the blanket that covers this country. It's a big responsibility. We help provide safety for Americans and their families … Our conversations need to change - we are a force to be reckoned with."

Hugh O'Toole kicked off the morning by sharing how advisors can (and must) use transparency to lead the way.

"The law is driving transparency. If you're not using data and technology, you're about to get run over. It's horrifying how little we're using data to level the health landscape. Transparency is the great disinfectant for any industry. Let data get in the way of your opinions and decisions. The art of opinion should stop. Any time someone doesn't want something to change, it's because they're making a lot of money the way things are. Health care is currently being unbundled so we can then rebundle it and make it accountable."

As always, Lester J. Morales brought his contagious energy, passion and personal experience.

Morales addressed the real life impacts of health care at the morning keynote, Structuring Health Plans so Everyone Wins!

"The system is built incorrectly. It's not broken- it's working exactly as it was designed… What we call premium, carriers and hospitals call revenues. Nobody wants lower revenues… Unlike everything else in life, quality and cost in health care have an inverse relationship.

"Doing things the right way is hard, but making it easy on people has gotten us into the mess we're in now. You can't impact health care that has already happened. You have to give people an advocate. They need someone to help shepherd them through the system… My parents would not have had to file medical bankruptcy if they'd been on a plan I had designed. I think about that every day.

"We've all been part of creating the problem - it's time to start becoming part of the solution. We won't be around as an industry if we don't make changes … Look in the mirror and ask "is it acceptable for me to continue doing what I've been doing?"

Ruby Ulloa Louis Suarez and Rosario Avila shared strategies for creating equity in the workplace through bilingual benefits translation.

"Don't confuse someone's accent with their intelligence … We need to recruit more people from different cultures for our industry so they can help build connections and understanding … Ask questions and don't make assumptions about groups of employees. Make sure employers don't make assumptions either."

Advertisement

Michael Patton, Erin Issac, Erin Duffy, Jim Schuerman, Mark Bellman and Tiffany Stiller shared holistic solutions for small businesses outside of the status quo.

"Brokers and advisors are no longer afraid of alternative ideas. There is also an explosion of new companies and products, as well as shifting regulations that have made this a very healthy environment. I believe it's now our fiduciary duty to make sure small employers are aware of these innovative ideas … We've seen big shifts recently toward level funding, RBP and other alternative options. But we can't sell them the way we do fully insured — our clients need these ideas but we have to be informed.

"The good new solutions coming in are putting more pressure on the legacy solutions. It's our job as advisors to vet them, understand them and explain them well."

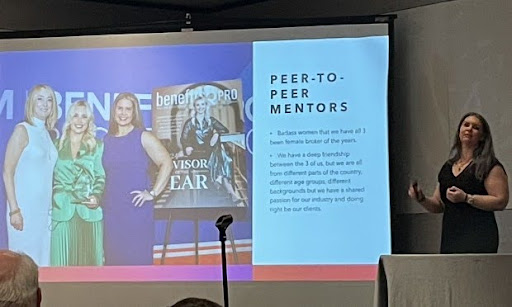

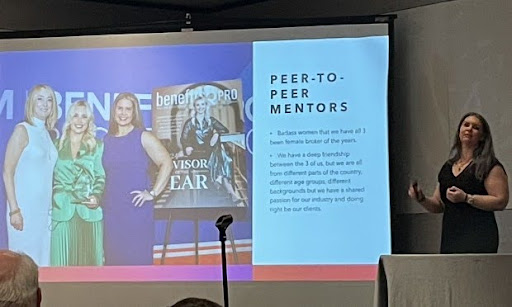

Susan L Combs shared why whether you're running your business or just living your life, one mentor is not enough.

"Business leaders who receive mentorship increase their annual revenue by 83% and stay in business longer … The only wrong way to have a mentor is not to have one at all … We always need to stretch in our lives to force us out of our comfort zones or we cease to grow as people… If I could only choose one kind of mentor, it would be a peer -- someone you can check in with constantly and ask even stupid questions. In order to kick ass, you must first lift your foot."

The conference closed out with a very popular panel: What's the Real Cost of Rx? And How Do We Fix It?"

Featuring Ali Goodwin, Bill Hepscher, Amanda Brewton, Robert Pfeiffer, Cheryl Larson and Eric Kohlsdorf:

"Misaligned incentives is another way of saying greed. The PBM landscape is becoming a monopoly and turning into a profiteering model. If you can sing the jingle, you can't afford the drug … PBM transparency means nothing until you can verify what they actually mean … Manufacturers don't like that people are starting to look behind the curtain and wondering why some countries pay far less for the exact same drugs…

"The big 3 PBMs own 75% of the market. Independent PBMs aren't competing against each other, we're competing against them … The big PBMs and carriers are enmeshed and there's no longer a way to track where one ends and the other begins … C-suite education is key -- advisors should educate your clients about what's going on. Employers are fiduciaries and need to understand what's happening … How can we possibly expect employees to make good benefit decisions if we don't help with the tools and education they need?"

Jessica Brooks Woods CEO laid out her vision for the association and the benefits industry.

"We're in unprecedented times and it's going to take an unprecedented level of commitment to make a difference …We are the blanket that covers this country. It's a big responsibility. We help provide safety for Americans and their families … Our conversations need to change - we are a force to be reckoned with."

Hugh O'Toole kicked off the morning by sharing how advisors can (and must) use transparency to lead the way.

"The law is driving transparency. If you're not using data and technology, you're about to get run over. It's horrifying how little we're using data to level the health landscape. Transparency is the great disinfectant for any industry. Let data get in the way of your opinions and decisions. The art of opinion should stop. Any time someone doesn't want something to change, it's because they're making a lot of money the way things are. Health care is currently being unbundled so we can then rebundle it and make it accountable."

As always, Lester J. Morales brought his contagious energy, passion and personal experience.

Morales addressed the real life impacts of health care at the morning keynote, Structuring Health Plans so Everyone Wins!

"The system is built incorrectly. It's not broken- it's working exactly as it was designed… What we call premium, carriers and hospitals call revenues. Nobody wants lower revenues… Unlike everything else in life, quality and cost in health care have an inverse relationship.

"Doing things the right way is hard, but making it easy on people has gotten us into the mess we're in now. You can't impact health care that has already happened. You have to give people an advocate. They need someone to help shepherd them through the system… My parents would not have had to file medical bankruptcy if they'd been on a plan I had designed. I think about that every day.

"We've all been part of creating the problem - it's time to start becoming part of the solution. We won't be around as an industry if we don't make changes … Look in the mirror and ask "is it acceptable for me to continue doing what I've been doing?"

Ruby Ulloa Louis Suarez and Rosario Avila shared strategies for creating equity in the workplace through bilingual benefits translation.

"Don't confuse someone's accent with their intelligence … We need to recruit more people from different cultures for our industry so they can help build connections and understanding … Ask questions and don't make assumptions about groups of employees. Make sure employers don't make assumptions either."

Advertisement

Michael Patton, Erin Issac, Erin Duffy, Jim Schuerman, Mark Bellman and Tiffany Stiller shared holistic solutions for small businesses outside of the status quo.

"Brokers and advisors are no longer afraid of alternative ideas. There is also an explosion of new companies and products, as well as shifting regulations that have made this a very healthy environment. I believe it's now our fiduciary duty to make sure small employers are aware of these innovative ideas … We've seen big shifts recently toward level funding, RBP and other alternative options. But we can't sell them the way we do fully insured — our clients need these ideas but we have to be informed.

"The good new solutions coming in are putting more pressure on the legacy solutions. It's our job as advisors to vet them, understand them and explain them well."

Susan L Combs shared why whether you're running your business or just living your life, one mentor is not enough.

"Business leaders who receive mentorship increase their annual revenue by 83% and stay in business longer … The only wrong way to have a mentor is not to have one at all … We always need to stretch in our lives to force us out of our comfort zones or we cease to grow as people… If I could only choose one kind of mentor, it would be a peer -- someone you can check in with constantly and ask even stupid questions. In order to kick ass, you must first lift your foot."

The conference closed out with a very popular panel: What's the Real Cost of Rx? And How Do We Fix It?"

Featuring Ali Goodwin, Bill Hepscher, Amanda Brewton, Robert Pfeiffer, Cheryl Larson and Eric Kohlsdorf:

"Misaligned incentives is another way of saying greed. The PBM landscape is becoming a monopoly and turning into a profiteering model. If you can sing the jingle, you can't afford the drug … PBM transparency means nothing until you can verify what they actually mean … Manufacturers don't like that people are starting to look behind the curtain and wondering why some countries pay far less for the exact same drugs…

"The big 3 PBMs own 75% of the market. Independent PBMs aren't competing against each other, we're competing against them … The big PBMs and carriers are enmeshed and there's no longer a way to track where one ends and the other begins … C-suite education is key -- advisors should educate your clients about what's going on. Employers are fiduciaries and need to understand what's happening … How can we possibly expect employees to make good benefit decisions if we don't help with the tools and education they need?"

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.

Paul Wilson

Paul Wilson is the editor-in-chief of BenefitsPRO Magazine and BenefitsPRO.com. He has covered the insurance industry for more than a decade, including stints at Retirement Advisor Magazine and ProducersWeb.