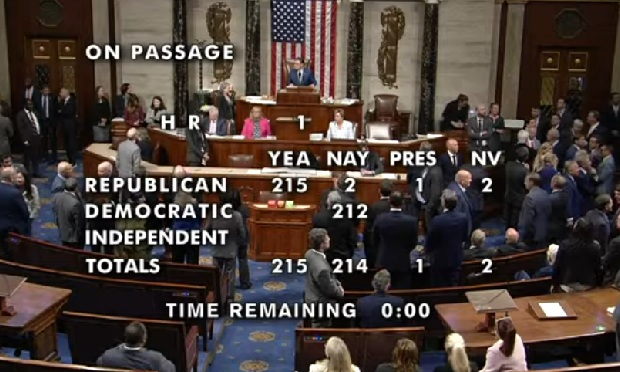

The final House vote tally for the One Big Beautiful Bill tax package. Credit: U.S. House

The final House vote tally for the One Big Beautiful Bill tax package. Credit: U.S. House

Members of the U.S. House voted 215-214 shortly before 7 a.m. today to pass the One Big Beautiful Bill tax and budget package — a bill that contains 13 provisions that could make the rules for health reimbursement arrangements and health savings accounts more flexible.

All Democrats who voted opposed the bill. All Republicans but three voted for it. Two Republicans voted against the bill, and one voted present.

Recommended For You

House members began debating the package on the House floor around 11 p.m. Wednesday, shortly after the House Rules Committee prepared the package for action on the House floor.

Related: House Ways & Means budget bill includes major ICHRA, HSA, paid leave and student loan provisions

Part of the House Rules process involved the consideration of dozens of amendments proposed by Democratic critics of the package. The proposed amendments all failed on party-line votes.

The committee did adopt a 42-page "manager's amendment" offered by House Budget Chairman Jodey Arrington, R-Texas.

The Arrington amendment package did not appear to affect the health account provisions in the package.

The health account provisions previously survived rounds of debate and amendment attempts at a House Budget Committee meeting.

At the House Rules Committee hearing, Democrats attacked provisions in the package that could reduce the number of people with Medicaid health coverage and reduce funding for the SNAP food assistance program by more than $300 billion over 10 years.

The critics did not attack the health account provisions in the package.

The health account provisions: The health account provisions in the package appear in sections 110201 through 110214.

One would change the name of the individual health coverage reimbursement arrangement program to the custom health option and individual care expense arrangement program.

The ICHRA program lets employers provide cash that employees can use to buy their own health coverage. Under current rules, employers cannot give workers a choice between ICHRA cash and traditional health coverage.

The CHOICE provision in the big tax bill would let an employer offer employees a chance to use other traditional, fully insured health coverage or a cash-for-coverage CHOICE program HRA.

Some of the HSA provisions would increase the contribution limits and make the accounts more flexible.

One, for example, would let workers who shut down flexible spending accounts roll unused FSA value into their HSAs.

The future: Republicans in the House and the Senate have been developing tax and budget packages in an effort to come up with budget legislation, keep the tax breaks created by the Tax Cuts and Jobs Act of 2017 in place, and meet policy goals set by President Donald Trump, such as protecting Medicare enrollees from major cuts.

Trump has been trying to help Republican leaders persuade the most moderate and most conservative congressional Republicans to vote for legislation their colleagues like.

House Speaker Mike Johnson said today that he hopes to work with the Senate to get a final tax and budget package through Congress and onto Trump's desk by July 4.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.