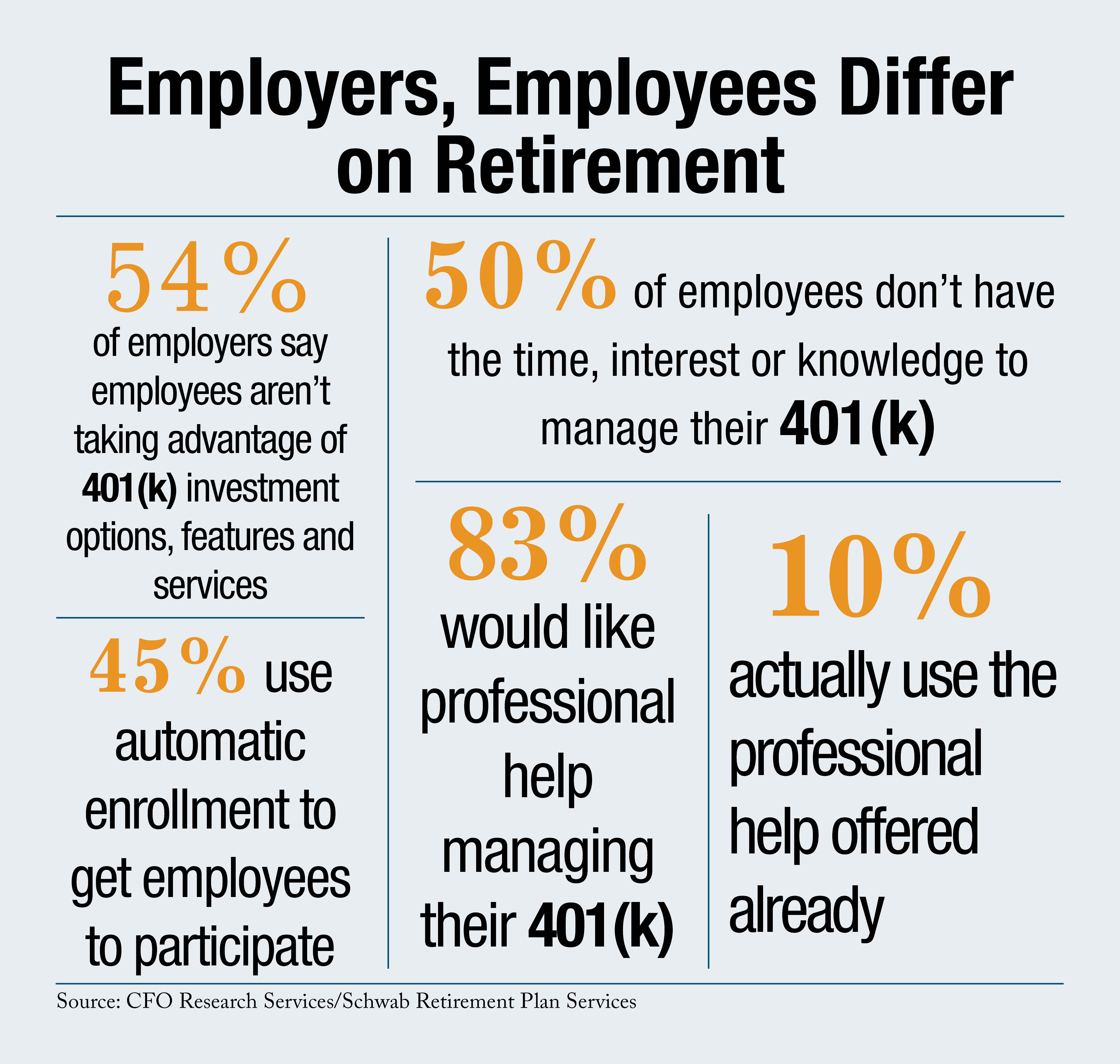

Most workers are unengaged when it comes to knowing more about their 401(k) plan's offerings and most are financially unprepared for retirement, according to two new studies by Schwab Retirement Plan Services.

CFO Research Services, on behalf of Schwab, surveyed more than 200 senior finance and human resources executives from large and mid-sized U.S. companies about their perceptions of 401(k) plans in the workplace. The survey found that more than half, 54 percent, of employers reported that employees participating in plans are not taking full advantage of the investment options, features and services offered in connection with their 401(k) plan.

The majority of employers surveyed said they plan to do a better job in educating their workers by using interactive planning tools, printed educational materials and in-person workshops.

The majority of employers surveyed said they plan to do a better job in educating their workers by using interactive planning tools, printed educational materials and in-person workshops.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.