American workers have changed their view of retirement in light of the recession, according to a new study by Transamerica Center for Retirement Studies.

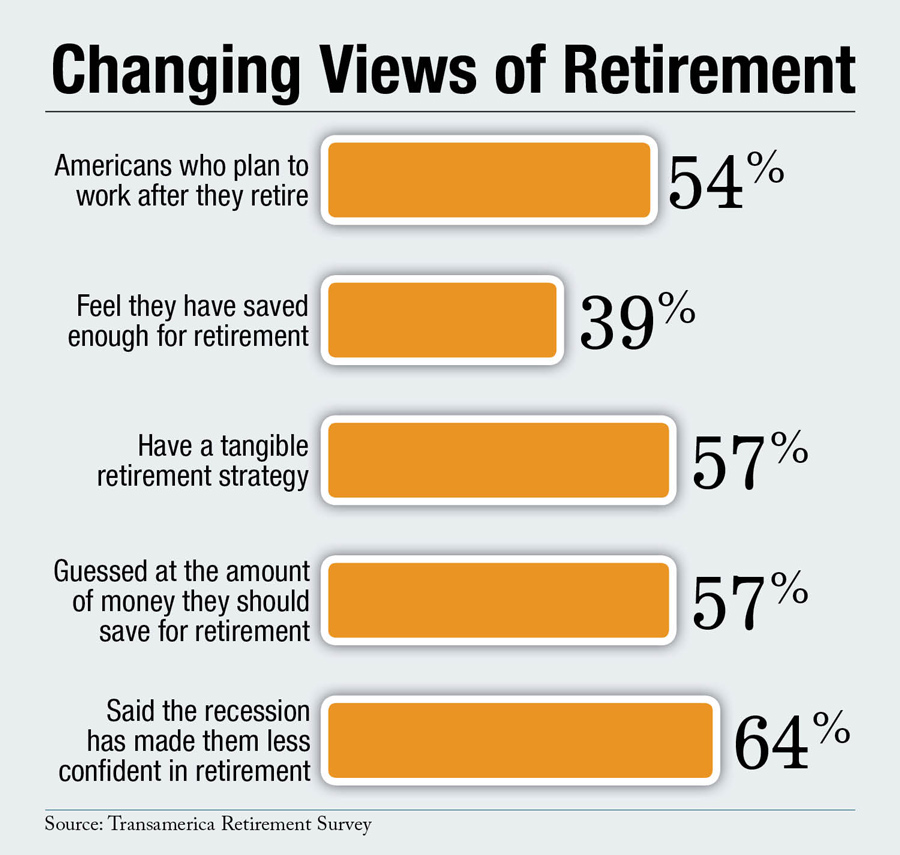

The 13th Annual Transamerica Retirement Survey found that the majority of workers plan to work past age 65 and 54 percent plan to continue working after they retire. Only 39 percent of the 3,600 interviewed as part of the survey said they felt they had saved enough for retirement.

"American workers are adjusting their expectations of retirement, including working past age 65 and planning to work part-time in retirement," said Catherine Collinson, president of the Transamerica Center for Retirement Studies. "American workers have reshaped their vision of retirement, now it's time to provide an updated roadmap to help them achieve retirement income to last throughout their lifetime."

Recommended For You

More than half (57 percent) of workers polled said they have a retirement strategy, either written or not written, and only 15 percent of those had factored in contingency plans for retiring sooner than expected or savings shortfalls. Forty-seven percent said they guessed at how much they would need in retirement. Transamerica identified five key ingredients for a new definition of retirement readiness, including:

- A clear vision of retirement including retirement dreams, expected retirement age and any plans to continue working in retirement

- Retirement income including savings and investments, pension benefits and government benefits

- A retirement strategy that incorporates savings needs, potential risks, and a back-up plan if forced into retirement sooner than expected

- Knowledge to make informed decisions about retirement investments, government benefits, and healthcare

- A family understanding and an open dialogue about finances and any expectations of support

Workers should have a clear understanding of where their retirement benefits are coming from, according to the report. That means knowing how much money will come from Social Security, defined contribution and defined benefit plans. They also should have a good grasp on what they will be spending on healthcare in retirement.

Of those surveyed in 2012, the median percentage of salary being saved was 7 percent, compared to 6 percent in 2011 and 2010. Seventy-seven percent of Americans say they participate in an employee-funded retirement savings plan. That percentage has held pretty steady since just before the recession hit in 2007.

Sixty-four percent of respondents said they are less confident they will be able to retire because of the recession.

Younger people, those in their 20s, have similar opinions about whether they will have saved enough by age 65 to retire. Sixty-four percent of them said they could work until they were 65 and not save enough for retirement, while 76 percent of people in their 40s felt that way.

When asked about their dreams for retirement, 41 percent of workers surveyed said they would like to travel. Twenty-two percent said they would like to spend more time with family and 17 percent said they would pursue hobbies. Very few people listed their dream as continuing to work, the report found.

Transamerica conducted the Harris online survey Jan. 13-31, 2012.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.