Despite some major recoveries in class actions over excessive 401(k) fees, the group of lawyers litigating these cases remains small, as few are willing to put the whole firm at risk.

“This is too big to do it in an incremental way. It does change the firm. It does mean that you put a massive amount of investment in up front,” said Jerome Schlichter, a founding partner at 21-attorney Schlichter Bogard & Denton.

Schlichter, who filed the first 401(k) lawsuits in 2006, said he knew from the start that these cases had the potential to put his firm out of business.

When Schlichter took on his first 401(k) class action, about 10 years ago, he found that no other firm was filing similar actions for excessive plan fees. By the time he filed a complaint, he had already put nearly two years into researching industry practices, he said.

“It’s similar to the cost-benefit analysis you make in an ordinary case, on steroids,” he said. “We made a decision to go all-in, and from a business standpoint that meant staggering risk, a staggering amount of resources, hiring people to do this work and knowing the guns would be pointed at us.”

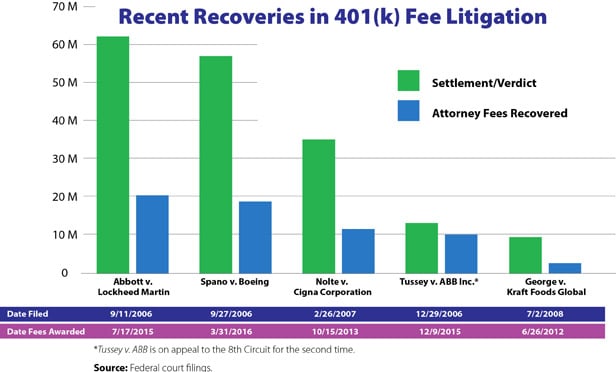

At first it seemed the defendants, with their double-digit teams of lawyers, would succeed in killing the effort, he said. In Tussey v. ABB, for example, defense counsel for ABB and Fidelity received $42 million in fees, according to a court filing in that case. Instead of backing away, Schlichter Bogard took the necessary steps to fight back. And now, suits are on the rise and so are the settlement figures and attorney fee recoveries.

“We had to grow. We had to take on numerous lawyers and other staff … we had to make vast investments in technology as a part of document review,” Schlichter said. “From a firm perspective, it was a very great need for resources for the staff to handle these cases.”

Schlichter has taken two of his early cases to trial, and they’re still pending, he said. Others have settled.

For instance, last year, Lockheed Martin Corp. agreed to the largest retirement plan settlement, $62 million, over claims the company invested more than 180,000 employees’ 401(k) savings in overly costly funds. Schlichter Bogard was awarded more than $20 million in fees, not including more than $1.8 million in expenses.

And earlier this year, a court approved a $57 million settlement from Boeing Co. in a 401(k) suit Schlichter filed, which included $19 million in attorney fees and $1.8 million in expenses.

In the past two to three years, as those settlements started to come in, Schlichter said, “other lawyers started noticing that these weren’t just going down the tubes,” leading to more case filings in the area.

A few other firms have taken an interest in similar claims. Nichols Kaster and Bailey & Glasser have filed complaints, for example.

“Up until recently we were really the only ones pursuing these types of cases,” said Michael Wolff, counsel at Schlichter Bogard. “We’re seeing now more firms getting involved in this litigation and going after other plans, certainly.”

However, he said, some firms may not realize the investment required.

“These are very difficult cases, very consuming, and it takes a lot of effort,” Wolff said. “You’re going up against some of the largest law firms in the country.”

Mark Boyko, who joined Bailey & Glasser earlier this year from Schlichter Bogard, said firms filing retirement plan class actions should be prepared to spend 10 years or more on the case, and tens of thousands of hours. “It’s an area of litigation where every case is different and new so there’s a large amount of uncertainty in the result you’re going to get and how long it’s going to take to get there,” Boyko said. “This is not one where you file the case with the expectation that the case is going to settle quickly.”

Boyko’s firm, along with plaintiffs firm Izard, Kindall & Raabe, filed a class action last week against Edward D. Jones & Co. alleging mismanagement of funds and excessive fees.

The work cannot be done with just a handful of people, Boyko said. It requires a relatively large plaintiffs firm.

Boyko said it takes an attorney three to five years to be fluent in retirement plan litigation. In addition to lawyers with an understanding of the financial issues at play, firms have to find expert witnesses who are both knowledgeable and willing to challenge industry practices, Boyko said. Paralegals also take time to develop their knowledge, he said.

One recent addition to the retirement plan plaintiffs bar is Sanford Heisler, which filed a suit last week against Columbia University for allegedly using expensive and underperforming retirement plan services. David Sanford, firm chairman and lead counsel on the suit, said Sanford Heisler has evaluated a number of Employee Retirement Income Security Act cases in the past, but did not find them strong enough to file a complaint.

“Because we evaluate them very carefully and we say no most of the time … we have a high confidence level” in the Columbia case, Sanford said.

The Columbia litigation comes on the heels of eight other lawsuits against major universities, all filed by Schlichter Bogard.

Sanford Heisler, which focuses on employment class actions, primarily works on discrimination cases, Sanford said. He said discrimination class actions are more labor intensive than the retirement plan case his firm took on, and he expects the Columbia case will get to trial in about two-and-a-half years. He said there was no need to hire additional staff, although the firm will need to seek out expert witnesses.

“I would hope that they would look at the same information that we’re looking at … and fashion a responsible settlement strategy,” Sanford said of the defense in the Columbia case.

If more retirement plan lawsuits result in multimillion-dollar settlements, it’s possible that more firms will want to file similar claims, Wolff said, but at the same time there has been a change in the retirement plan landscape. Plans are being run better and with lower fees, he said.

Schlichter said this is a result of the litigation that has begun to work its way through the courts. Eventually, he said, there may not be more cases for lawyers to take, even if they want to.

He said his partners have taken other kinds of cases that resulted in successful recoveries. Even he has handled some cases outside retirement plan lawsuits, like a products liability case against the maker of a firefighter’s mask, which resulted in a $27 million verdict. But still, those recoveries cannot fund the investment required for retirement plan litigation, he said.

“If it was simply a matter of economics, the decision of whether to take on this risk of betting the farm would not be a decision you would make,” he said. “You’ve got to believe in the cause and believe that you can accomplish something beyond the individual cases to take on this kind of risk.”

The Reward It was largely Schlichter Bogard’s own work that could cause the firm’s bread and butter cases to dry up. In fee award after fee award, courts have cited to the firm’s groundbreaking work in this area.

“The court notes that class counsel’s enforcement of ERISA’s fiduciary obligation has contributed to rapid reductions in the level of 401(k) recordkeeping fees paid across the country.” U.S. District Judge Harold A. Baker of the Central District of Illinois said in Nolte v. Cigna. “The law firm Schlichter, Bogard & Denton is the leader in 401(k) fee litigation.”

Several courts pointed to the changing landscape in 401(k) plan management, attributing to this type of litigation at least $2.8 billion in savings to plan members. Schlichter himself noted that, eventually, there will be no more claims for lawyers to bring.

“Additionally, few lawyers or law firms are capable of handling, much less willing to handle, this type of national litigation,” Baker said in Nolte. “None have the proven record of Schlichter, Bogard & Denton.”

While other firms are starting to get into the game, Schlichter Bogard was listed as the only plaintiffs firm in the majority of the cases tracked by Law.com. Occasionally, a local counsel would be named.

The small sample of cases highlights the amount of time from filing to settlement—an average of more than seven years—and the amount of attorney hours that went into each case, which was as high as 33,000 hours.

These cases have put a lot of defense firms to work as well.

Mayer Brown, Schulte Roth & Zabel and Dowd Bennett represented the defendants in Lockheed Martin’s $62 million settlement accord last year. O’Melveny & Myers and Bryan Cave were on for the defense in Spano v. Boeing, the second largest 401(k) fee accord at $57 million. Morgan, Lewis & Bockius has defended a few excessive fee cases. Other firms on the defense have been Jackson Lewis, Jenner & Block, Lathrop & Gage, Goodwin Procter and Seyfarth Shaw.

Gina Passarella contributed to this report.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking benefits news and analysis, on-site and via our newsletters and custom alerts

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the property casualty insurance and financial advisory markets on our other ALM sites, PropertyCasualty360 and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.