(Image: ThinkStock, CMS, Allison Bell/ALM)

(Image: ThinkStock, CMS, Allison Bell/ALM)

Here's some good news for advisors with clients on Medicare earning more than $85,000 asindividuals and $170,000 as couples filing jointly: Starting nextyear, the income brackets linked to surcharges for Medicare Parts B(medical services and supplies) and D (prescription drugs) will beindexed to inflation for the first time since 2010.

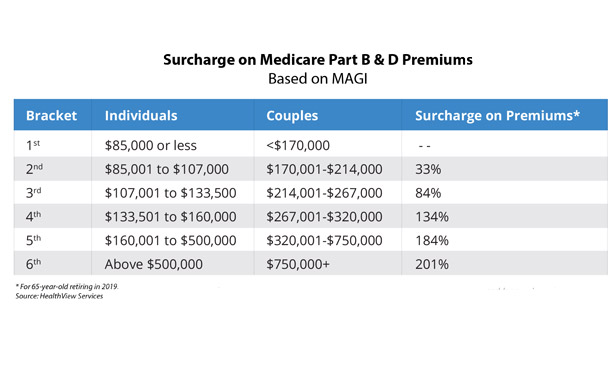

|There are five income brackets linked to different surchargepercentages, ranging from 33% to 201%, which are applied as anadditional cost to the base premium. (See table below.)

|The top income bracket, above $500,000 for individuals and above$750,000 for couples, won't be indexed to inflation until 2028. Thesurcharges are officially known as the Income-Related MonthlyAdjustment Amounts (Irmaa).

|

The inflation indexing of the surcharge, which uses the ConsumerPrice Index for All Urban Consumers (CPI-U), was previously ineffect from 2007 through 2010, then temporarily ended by theAffordable Care Act until 2020.

|With the renewed indexing of incomes, "Americans will need tohave higher income levels to be subject to the added cost ofsurcharges — a positive development for current and future Medicarerecipients," according to a new report from HealthView Services.

|But, says the firm's CEO, Ron Mastrogiovanni, "given thepressure on the Medicare Trust Fund, retirees should expectadditional changes and cost shifting to make up for lostrevenues."

|The Trust Fund will collect less money from Medicarebeneficiaries as a result of the inflation indexing while healthcare costs continue to rise, putting even more pressure on theprogram.

|"To maintain the solvency of the Medicare Trust Fund, revenue nolonger generated from surcharges must be recovered from othersources," the report notes.

|According to the latest Medicare Trustees report, the trust fundfor Medicare Part A, for hospital insurance, will be exhausted in2026, resulting in an 11% cut in spending if no financing changesare made.

|Medicare Parts B and D funds are not projected to be exhaustedbecause the government can simply raise the premiums paid bybeneficiaries to cover the programs' rising costs.

|The HealthView Services report notes that reductions in Medicarebenefits are already underway. The government has alreadyeliminated the Supplement insurance Plans F (the most popularsupplemental plan), to and Plan C, beginning on Jan. 1, 2020. Bothplans cover help beneficiaries cover the gaps in costs that theyare required to pay for.

|"A series of smaller changes will add up over time, affectingAmericans' retirement," Mastrogiovanni tells BenefitsPRO's sistersite, ThinkAdvisor, adding that Medicare beneficiaries in the lowerincome bracket who struggle to pay out-of-pocket costs anddeductibles will be most affected.

|He also notes that it's important for retirees and theiradvisors to be careful about drawing down assets inretirement because some assets, such as certain types of lifeinsurance and annuities, can provide tax-free retirement cash flowthat can produce a lower modified adjusted gross income andtherefore help reduce Medicare surcharges.

|READ MORE:

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.